What is important to focus on is the significant slowdown in urban consumption, even as some green shoots of rural consumption revival have been noted. This doesn’t bode well for the economy as a whole as urban centres are the big drivers of demand. We took a look at some data sets to try and glean what ails urban consumption. And the answers are quite intuitive.

Drought in organised jobs

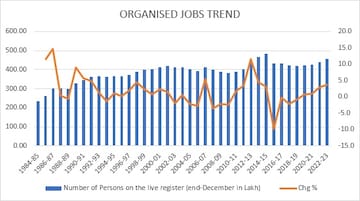

Data from RBI’s annual report on employment in the organized sector, both public and private organisations (Source: Ministry of Labour), reveals a very telling tale.

While growth in the economy (GVA) has exhibited a strong show since FY13, there has been almost no growth in organized sector jobs. India had 447.9 lakh people registered in the organized sector in FY13, which rose to barely 457.2 lakh in FY23. That is a compounded growth rate of an abysmal 0.2%.

Organised employment and GVA

| Year | GVA growth (%) | OE growth (%) |

| FY13 | 5.4 | 11.5 |

| FY14 | 6.1 | 4.5 |

| FY15 | 7.1 | 3.1 |

| FY16 | 8 | -9.9 |

| FY17 | 8 | -0.3 |

| FY18 | 6.2 | -2.2 |

| FY19 | 5.8 | -0.8 |

| FY20 | 3.9 | 0.7 |

| FY21 | -4.1 | 1 |

| FY22 | 9.4 | 2.9 |

| FY23 | 6.7 | 3.7 |

For an economy on the growth path, the organized sector should logically expand at a rapid pace, and this should reflect in significant growth in jobs.

That hasn’t quite been the case. In fact, in FY16, the organised jobs tally was 482.6 lakh, higher than the number for FY23.

The income skew

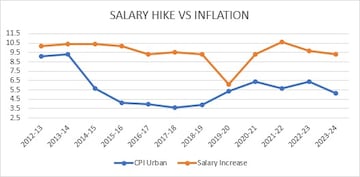

The other reason behind the recent consumption slowdown for mass products seems to the lack of income growth for the employed.

For one, the annual increments have seen a downshift from healthy double-digit levels to single digit increases, reveals data from AON Hewitt.

And while inflation too has tempered a bit, the shift by organisations in outsized rewards for performers and key personnel at the cost of the rest has skewed the income distribution, with some having high income growth and others seeing tepid increments.

The higher incomes for a few combined with asset inflation leading to higher networth of a small section of the population seems to be driving consumption at the premium end. However, for growth to be sustainable, the vast masses have to participate in India’s consumption story. And that remains the big worry.

One segment of the economy that had kept the jobs growth ticking at the entry and junior level, leading to growth in urban consumption was I.T. Services, but that engine in the recent past has been sputtering, and a revival in its prospects can be one possible ray of hope. But that alone won’t fix India’s jobless growth problem. More needs to be done.

First Published: Dec 1, 2024 1:09 PM IST