A CNBC-TV18 poll saw the Q2 GDP growth at 6.5%, which itself seemed pessimistic compared with the RBI forecast of 6.8%. And RBI’s downgrade to 6.8% is only a month old. As recently as Oct 9, during the monetary policy announcement, the central bank was confident of a 7% growth in the second quarter.

Central banks are traditionally conservative in their forecasts. Rarely have actual growth numbers been 160 basis points below the RBI’s forecast. To be sure the central bank and the government will be hard at work on how to bring the economy back to at least a 6.5% growth pace.

What went wrong in Q2? There were many warning signs. The second quarter earnings of Nifty companies grew by just 4%, and this was the second straight quarter when the Nifty earnings grew in low single digits. Within Nifty, metal companies’ earnings were expectedly disappointing as margins were coming off a high base. Likewise for oil & gas companies.

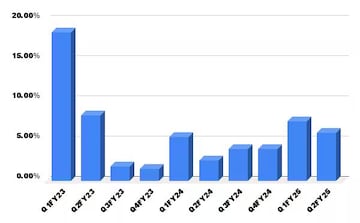

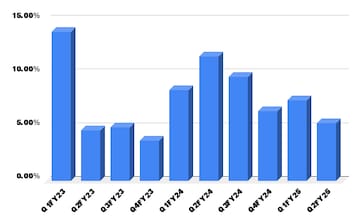

The government has to take a large part of the blame. While private consumption had been weak in FY23 and FY24, government capex (which gets counted under gross fixed capital formation) was growing between 7 and 11% in most of the last 12 quarters, and this was the key reason for the 7-8% growth pace from FY22-Fy24.

Rate Of Growth (%) Of Private Consumption (Source: Mospi, CNBC-TV18)

Also read: India’s Q2 GDP growth slows to a shocking 5.4%, lowest since Q3 FY23

Rate Of Growth (%) Of Gross Fixed Capital Formation (Source: Mospi, CNBC-TV18)

But in Q2, India’s capex growth appears to have slowed to 5.4% largely because the government failed to do their bit. States’ capex is probably affected by high revenue expenditure on promised income transfers (like the Ladki Bahin Yojana in Maharashtra). But what explains the slowdown in central capex? Data released on Friday shows that central government capex during April-Oct 2024 is 15% less than in April-Oct 2024. Even for October alone, central government capex at 51,579 cr is nearly 10% lower than the 56,296 crores of capex in Oct 2023.

Now as we look back, we need to ask ourselves one serious question: Was the economy growing at over 7% only because of fiscal and monetary looseness? Remember, the fiscal deficit was running at well over 5% for the last 4 years and monetary policy was loose until early 2023. Also thanks to the heavy dollar printing by the fed since mid-2020, a wave of cheap equity money had flooded Indian start-ups including fintechs. Did all these collectively boost economic growth to an above-potential 7%+ growth since FY22? It appears in hindsight that the easy money available with banks, NBFCs, MFIs and above all fintechs from 2021 to 2023 propped up consumption. The RBI began to smell the trouble from over-lending a year back when it moved to caution banks against 30% growth rates in retail lending and even raised risk weighs on unsecured loans back to pre-COVID levels.

A lot of stock investors and even some policymakers are arguing that the RBI tightened too much. It’s easier to sound clever in hindsight. The central bank had to tighten in August 2023 on the back of consecutive months of 7%-plus inflation. Also, it was hardly “tightening” lending. It only brought the risk weights back to pre-covid levels. We probably need to acknowledge that the economy’s potential growth is probably 6.5% but excessive global and domestic liquidity had engendered a faster growth pace which stumbled the moment the steroid doses were reduced.

Also read: ‘Far below hype’ Jairam Ramesh slams govt over GDP growth slump

One can still make the argument that growth may rebound smartly in the current and next quarters. the kharif harvest has been excellent and rabi is expected to be likewise due to high reservoir levels. Government capex too should be under way at a frenzied pace since October to make up for lost time. However, at the moment the only data that is encouraging is 2-wheeler sales. As per Vaahan data, 2-wheeler sales grew by 19% in November. However heavy commercial vehicle sales have fallen 7% from year-ago levels, while car sales are down 14% y-o-y, as per vaahan numbers. Anecdotal chats with cement dealers and home loan lenders reveal that residential real estate growth seems to have slowed in some cities due to oversupply and poor demand.

The Q2 GDP data puts RBI in a very uncomfortable position on Dec 6 when they announce the monetary policy. Given that the inflation-targeting framework requires them to bring inflation to 4% (+/-2%), it can hardly cut rates when the last available inflation number at 6.2% is above the upper limit of its target range of 2-6%. And yet the government has already exhibited its impatience with the RBI’s hesitation to lower rates. Minister Piyush Goyal, told CNBC-TV18, on Nov 14 that he wanted a rate cut from RBI, while Finance Minister Nirmala Sitaraman obliquely agreed when she said the next day that the inflation-interest rate dynamics need more discussion.

Perhaps the RBI could find a via media by cutting the cash reserve ratio or the CRR to 4% from the current 4.5%. That will immediately release one lakh cr of liquidity into the banking system. The liquidity infusion is needed even to counter the sucking out of rupees created by the dollar sales by RBI over the past month to keep the rupee from depreciating too fast.

And technically RBI need not even wait for the monetary policy day to announce a CRR cut, since the CRR is not a responsibility of the Monetary Policy Committee (MPC).

Such steps will take their time to make an impact on the real economy. For now, most economists are bringing down their growth forecasts to 6%-6.5%,a far cry from the 8% average the economy had grown at from FY22-Fy24. The worry is that signs of a slowing economy along with the already high uncertainty engendered by the expected Trump tariffs should not dampen the animal spirits and smother the nascent private capex cycle. Then the slowdown can become self-fulfilling.