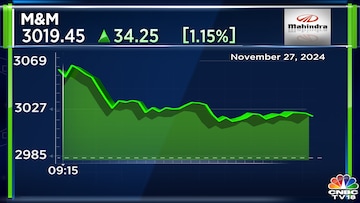

Though the auto stock ended more than a percent lower ahead of target launch yesterday, Morgan Stanley has retained its overweight stance. It has set the target price at ₹3,336, implying a potential upside of nearly 12% from the closing price of November 27.

Morgan Stanley noted that Mahindra’s new launches — BE 6E and XEV 9E Electric SUVs — are priced in-line with premium variants.

| Brokerage | Rating | Target price (₹) |

| Morgan Stanley | Overweight | 3336 |

| Nuvama | Buy | 3700 |

| Motilal Oswal | Buy | 3420 |

The remark comes as Mahindra and Mahindra has priced the BE 6e starting at an ex-showroom price of ₹18.9 lakh and the XEV 9e is likely to cost ₹23.59 lakh, Rajesh Jejurikar, Executive Director, said. With these aggressive price points, the company is positioning itself as a strong contender in the burgeoning EV market.

The on-road price of the BE 6e is expected to be ₹20.36 lakh, making it a more affordable alternative to market favourites like the Toyota Rumion and Maruti Suzuki Ertiga, which currently dominate the utility vehicle segment with combined monthly sales of 21,000 units.

Morgan Stanley believes that though the carmaker’s EV offtake has been slower than initially expected, the offtake of pure EV models will be key to watch. According to the brokerage, success of new models will also help M&M in meeting CAFE 3 norms.

(The Corporate Average Fuel Economy (CAFE) 3 norms are a set of stricter carbon emission standards for vehicles in India that are expected to be implemented from 2027-2032. The norms set a carbon emission target of 91.7 grams of carbon dioxide per kilometer (gm CO2/km) for passenger vehicles.)

Nuvama, on the other hand, is of the view that Mahindra is augmenting its EV focus with BE.6e and XEV.9E models, which are based on a new dedicated EV platform that scores over peers on features. However, the two have been priced competitively, the brokerage said.

The SUVs major features include large battery, fast charging capabilities, high seating/storage space, and ADAS level 2+ features, it noted, adding that the bookings for these vehicles are likely to open from January 2025 whereas deliveries could begin by the end of February 2025. The initial annual BEV capacity is at 90,000 units, the brokerage pointed out.

As per Nuvama’s estimates, the company is expected to record BEV volumes at 48,000 units in FY26.

The brokerage reiterated that M&M remains one of its top picks, led by expectations of revenue and core earnings increasing at compound annual growth rate (CAGR) at 15% and 18% over FY24–27. This shall sustain return on invested capital (RoIC) at more than 45%, the brokerage said.

Nuvama retained its buy rating with target price of ₹3,700, which means it expects the stock to further rally 24%.

Motilal Oswal is of the view that M&M’s indigenously designed Inglow platform seems to be extremely versatile and scalable given it is modular in nature. “We were particularly impressed with the multiple first-in-class features offered in both these products. These, when combined with the introductory pricing makes them a truly strong value proposition for customers.”

It added that the pricing is certainly competitive, and so it remains to be seen how many new customers are attracted to M&M post this launch, given the lack of adequate charging infrastructure in the country.

Hence, Motilal Oswal remains cautious on the incremental volumes that this segment can deliver, at least in the near term. “We estimate MM to post a CAGR of 13%, 16%, and 15.5% in revenue, EBITDA and PAT over FY24- 27.”

The brokerage has also maintained its buy rating on M&M with target price of ₹3,420.

In the past year, M&M shares have made investors 95% wealthier as against benchmark Nifty 50’s rise of 22% during the period.

With the launch of the new electric SUVs, the maker of the iconic Scorpio, Thar and XUV700 has now positioned its EV offerings against top luxury car makers. CNBC-TV18 had reported on October 31 this year that Mahindra Group has hired a dedicated sales team of 500 professionals to promote the car at dealerships across the country.

At present, Mahindra Group only has an eXUV in the market. Once the new EV SUVs hit the market, they will compete with Tata Motors, MG and Hyundai in the electric vehicle segment.

M&M shares traded 2.49% higher at ₹3,059.65 on NSE at 9:20 am.

Track latest stock market updates on CNBCTV18.com’s blog here