Zomato is the first new-age tech stock that will replace JSW Steel in the BSE Sensex as part of the index reconstitution, which will come into effect from December 23.

The food delivery platform’s entry in the 30-stock index comes amid a stellar rally seen in the counter during the last 12 months, surging 126% so far this year. On the other hand, JSW Steel’s shares have given 10% during the same period.

Shareholders of Zomato have also gave a greenlight to its ₹8,500 crore fundraise through the QIP mode. Earlier in October, the board of Zomato had also approved this fund raise to bolster its balance sheet.

The food delivery giant said that its cash reserves fell by ₹1,726 crore during the September 2024 quarter, primarily due to the ₹2,014 crore acquisition of Paytm’s entertainment ticketing business.

Zomato’s cash balance now stands at around ₹10,800 crore, down from ₹

14,400 crore, following investments in quick commerce and acquisitions.

While the business has transitioned to generating cash since its IPO days, the company aims to strengthen its cash position to compete effectively in a challenging market.

Recently, two brokerage firms came out with contrasting views on Zomato, while one is expecting the stock to double, the other expects the stock to halve from the current levels.

Global brokerage firm Morgan Stanley has maintained an ‘Overweight’ rating on the counter, and also upped its price target to ₹355 from ₹278 per share earlier. This is the second-highest price target on the Street for Zomato after CLSA’s ₹370.

The brokerage expects Zomato to be a potential doubler in the next three to four years.

On the flip side, Macquarie has an ‘Underperform’ recommendation on Zomato, with a price target of ₹130 per share.

Out of the 27 analysts that track Zomato, 24 of them have a ‘Buy’ rating, while the other three have a ‘Sell’ rating on the counter.

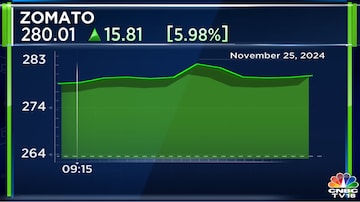

Zomato shares are trading 6.25% higher at ₹280.71 on the NSE. The stock has more than doubled so far in 2024 and is trading with gains of 126%. Over the last 12 months, the stock has risen nearly 147%.