Currently, India offers two income tax regimes: the new tax regime and the old tax regime, each with its distinct tax slabs.

Let’s take a look at the current tax slabs for both regimes:

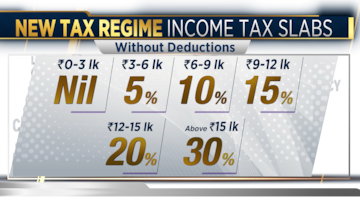

New Tax Regime Slabs (FY 2024-25)

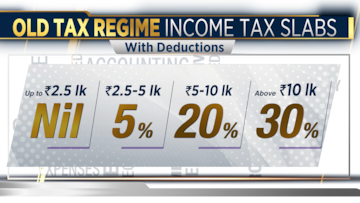

Old Tax Regime Slabs (FY 2024-25)

While the new tax regime provides a simpler structure with reduced rates, it offers no room for deductions, which many individuals rely on to reduce their taxable income.

In contrast, the old tax regime allows various exemptions and deductions but comes with higher tax rates.

Calls for restructuring tax slabs

Financial experts have proposed further restructuring of the tax slabs to provide relief to taxpayers and simplify the system.

TV Mohandas Pai, former CFO of Infosys, suggested a simplified structure to ease the burden on middle-income taxpayers.

His proposal includes:

- Up to ₹5 lakh: Nil

- ₹5–10 lakh: 10%

- ₹10–20 lakh: 20%

- Above ₹20 lakh: 30%

He also recommended that surcharges be restricted to incomes above ₹50 lakh to reduce the burden on middle- and upper-middle-income groups.

Anand Bathiya, President of the Bombay Chartered Accountants’ Society (BCAS), emphasised that while

corporate taxes have been reduced, the tax rates for non-corporate entities, including LLPs, partnership firms, and individuals, remain high.

He proposed capping individual tax rates, including surcharges and cess, at 30% to align with corporate tax structures.

Industry chambers like the Confederation of Indian Industry (CII) and Assocham have emphasised the need to address the growing gap between individual and corporate tax rates.

Currently, the highest marginal rate for individuals is 42.74%, while the corporate tax rate stands at 25.17%, leaving a disparity that some feel is too wide.

CII has suggested that the government consider reducing marginal tax rates for personal incomes up to ₹20 lakh per annum, a move they believe would help stimulate consumption, growth, and tax revenue.

Similarly, Assocham has urged the government to reduce personal income tax rates, highlighting how corporate tax rates have been lowered over the years, exacerbating the gap.

They argue that the highest marginal tax rate of 42.74% for individuals is excessively high compared to the corporate tax rate of 25.17%.

Impact of tax reforms

Samir Kapoor, an independent consultant, stressed the importance of revising tax deductions under sections like 80C and 80D to offset inflationary pressures and provide meaningful relief. He also suggested that increasing the exemption limit or standard deduction would put more disposable income in taxpayers’ hands, boosting demand.

Prakash Hamirwasia, Partner, Direct Taxation at Sudit K. Parekh & Co. LLP, pointed out that reducing personal income taxes would stimulate consumption, as taxpayers would have more disposable income.

This, in turn, would lead to an uptick in demand for consumer goods and services, generating higher indirect tax collections (GST).

Hamirwasia also noted that reducing tax rates for lower-income brackets would be especially effective, as it would increase the purchasing power of a larger section of the population.

But will government consider changes?

According to a Reuters report, the government may be considering cutting income tax for individuals earning up to ₹15 lakh per year in the upcoming Budget.

If the government reduces tax, the move is likely to benefit tens of millions of taxpayers, especially city dwellers burdened by high living costs.

As per the report, the relief would be applicable to those opting for the 2020 (new) tax regime under which annual income of ₹3-15 lakh is taxed at between 5-20%.