Thakkar pointed out that in the digital industry, fixed costs remain constant, and additional customers can be served without significantly increasing expenses. “So, we will wait for one or two quarters before deciding on any price hike, if needed.”

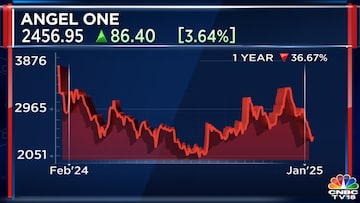

Angel One’s shares shed over 7% on January 13 following a muted December quarter performance, which was significantly impacted by the new Futures & Options norms implemented by SEBI, along with weak market sentiment.

Revenue fell 17% sequentially to ₹1,262 crore, with a 500-basis point contraction in earnings before interest, tax, depreciation, and amortisation (EBITDA) margin to 39.3%. Net profit declined 34% from the previous quarter to ₹281 crore.

Angel One also recently received the necessary licenses for its wealth business and will begin reporting the segment’s performance from the current quarter.

“We are hopeful about the opportunity in the market where emerging high net-worth individuals (HNIs) have not received the same kind of service that is available to HNIs and ultra-HNIs. So, apart from being present in Ultra HNI and HNI, we would like to use technology to create efficiency and offer better products on our app.”

Also Read: CLSA expects single-digit gains for the Indian market this year

The company’s current market capitalisation is ₹21,652.06 crore. Its shares have fallen by nearly 39% over the past year.

For the full interview, watch the accompanying video