“He has stabilised the macroeconomic situation by reducing inflation, stopping budget deficit and creating investment friendly regimes,” R Viswanathan, ex-Indian envoy to Argentina, told CNBC-TV18.

Milei, who supports minimal or no government interference in economic matters, began his tenure when Argentina was going through its worst economic crisis in at least two decades. Annual inflation was at 211%, the poverty rate stood at 41.7%, and the economy had contracted by 1.6% for the full year.

The 54-year-old’s promised “shock treatment” began on his first day as the president, when he cut down the size of his government. Other “shock treatments” have included a 50% peso devaluation, cutting fuel subsidies, and reducing the social expenditure.

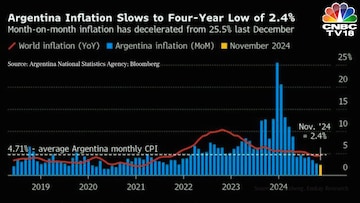

The impact could be seen almost immediately. Monthly inflation fell from 25.5% in December 2023 to 20.6% in January 2024, as per the INDEC statistics agency.

Controlling inflation has been Milei’s biggest success so far. Annual inflation has fallen from 211% to about 120%. Moreover, the monthly inflation rate has fallen to under 3% in December, the lowest in at least four years.

“Milei has delivered on his election campaign promise to drastically cut public spending, helping tackle what he considers is Argentina’s main economic problem: Inflation,” said Hari Seshasayee, Co-Founder of Consilium Group, a Latin America advisory.

As per various estimates, Milei’s administration has cut public spending in Argentina by nearly 30%, primarily by slashing subsidies in gas, electricity, and other public utilities.

Cutting public expenditure is a big deal in Argentina, where decades of populism by successive governments led to unsustainable budgets that broke fiscal discipline. Previous governments borrowed large sums, primarily from the IMF, and printed more money to finance the deficit. These measures, however, caused inflation and depreciated the value of the Argentine peso.

The dramatic cut in public expenditure has helped the country to post its 10th consecutive month of budget surplus. In fact, reports suggest that the country has eliminated a budget deficit for the first time in 123 years.

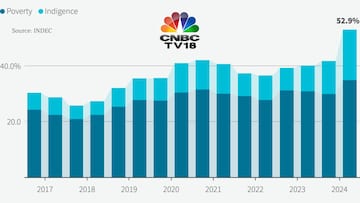

However, poverty continued to rise in 2024. Poverty levels reached 53% in the first half of last year, the highest in at least 20 years, according to researchers at the Argentine Catholic University.

“The middle class has been hurt with reduction of earnings and subsidies, while the poor have been impacted after cuts in social welfare expenditure,” said Viswanathan.

Nevertheless, another research by economist Martín González-Rozada showed that poverty actually fell in the second half of 2024, coming down to as low as 36.8%.

While Milei’s reform push has antagonised the working class, global investors continue to hail the libertarian.

The Argentinian stock market has surged 172%, becoming the best performing index in 2024. In comparison, the S&P 500, despite the talks of a tech boom and ‘Trump rally,’ rose just 25% last year. In fact, The Wall Street Journal dubbed investing in the Argentine stock market as the “the hedge fund trade of 2024,” noting that investors bet on Milei to rescue the troubled economy.

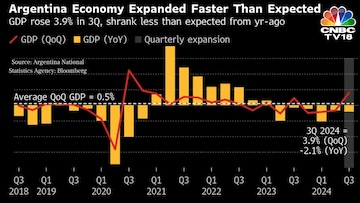

Argentina’s economy escaping recession in the July-September quarter has been the cherry on the cake for the 54-year-old. The GDP expanded 3.9% from July to September compared to the previous three-month period. The economy had gone into recession between October 2023 and June 2024. The better-than-expected result surprised many and strengthened his position ahead of mid-term polls this year.

But several challenges await Milei in 2025.

The peso has appreciated by over 40% against the US dollar in the last one year. While this seems like a victory for Milei’s reforms, any external shock can weaken the currency. “If the Trump administration puts large tariffs on China, this will unleash a wave of devaluations across emerging markets,” said Robin Brooks, senior fellow at the Brookings Institution, told Financial Times.

Moreover, the economic shock therapy has led to 35,000 state employees losing their jobs, real wages falling by at least 10%, and almost all manufacturing activity coming to a standstill.

“Milei has started his term well, enacting some policies that have brought about much-needed stability. For these policies to bear fruit in the long term, he must bring some balance in 2025 by spurring economic growth and focusing on job creation,” said Seshasayee.

The Argentine president is also close to securing another tranche of loan from the IMF, which will add to the country’s already huge debt burden of $44 billion. This, Viswanathan said, will come at the expense of funds for poverty alleviation.

“Both the Left and the Right messed up the economy in the 2010s. The people voted to give newcomer Milei a chance. So far, not bad. But the only problem is that he is likely to make the rich richer and the poor poorer,” the veteran diplomat argued.