Index Fund Corner

Sponsored

| Scheme Name | 1-Year Return | Invest Now | Fund Category | Expense Ratio |

|---|---|---|---|---|

| Axis Nifty 50 Index Fund | +32.80% | Invest Now | Equity: Large Cap | 0.12% |

| Axis Nifty 100 Index Fund | +38.59% | Invest Now | Equity: Large Cap | 0.21% |

| Axis Nifty Next 50 Index Fund | +71.83% | Invest Now | Equity: Large Cap | 0.25% |

| Axis Nifty 500 Index Fund | — | Invest Now | Equity: Flexi Cap | 0.10% |

| Axis Nifty Midcap 50 Index Fund | +46.03% | Invest Now | Equity: Mid Cap | 0.28% |

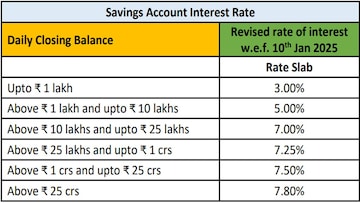

According to the filing, balances up to ₹1 lakh will continue to earn an interest rate of 3.00%, while the extended slab for balances between ₹1 lakh and ₹10 lakhs will provide an interest rate of 5.00%. Furthermore, newly introduced slab for balances above ₹10 lakhs and upto ₹25 lakhs deliver an interest of 7%.

Another new slab for balances ranging from ₹25 lakhs to ₹1 crore offers a rate of 7.25%, and balances from ₹1 crore to ₹25 crores will earn 7.50%. For balances above ₹25 crores, the existing rate of 7.80% remains unchanged.

The interest for savings accounts will be calculated daily and credited quarterly.

The bank stated, “With these changes, Equitas Small Finance Bank reiterates its commitment to providing industry-best rates and unparalleled benefits for its customers.”

(Edited by : Ajay Vaishnav)