| Company | Value | Change | %Change |

|---|

While steel prices remained under pressure throughout the year, valuation multiples expanded as the market appeared to be looking past the ongoing weakness and anticipating a recovery in 2025.

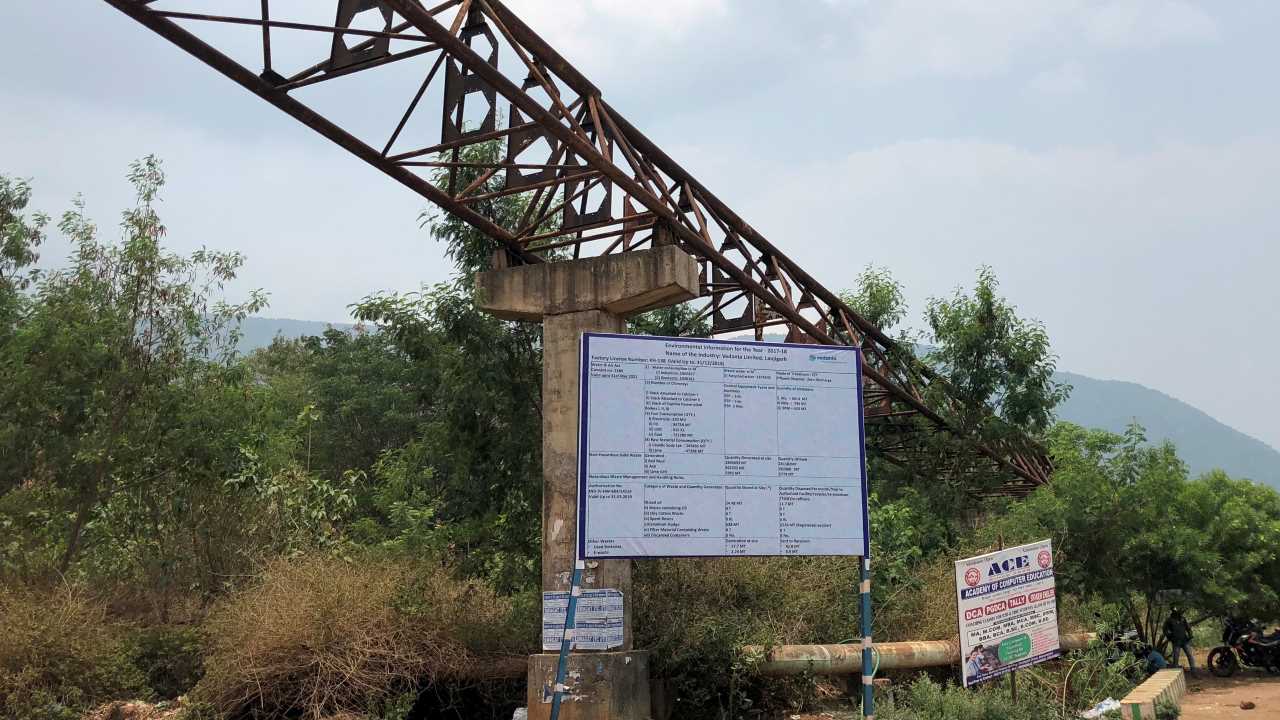

Stocks like Vedanta and Nalco impressive total shareholder returns (TSR) of 89.1% and 66.9%, respectively, driven by favorable earnings momentum supported by strength in base metals.

| Stocks | Rating | CMP | TP | Upside |

| Coal India | Buy | ₹384 | ₹600 | 56% |

| Hindalco | Sell | ₹602 | ₹600 | – |

| National Aluminium Co | Buy | ₹212 | ₹275 | 30% |

| Vedanta | Buy | ₹444 | ₹600 | 35% |

Looking ahead, Emkay expects Vedanta to remain in the spotlight due to a big demerger event on the horizon. The brokerage has a ‘Buy’ rating on Vedanta, with a price target of ₹600 per share, representing a potential upside of 35% from the current levels.

Nalco has several catalysts in place that are likely to support earnings momentum over the next two years. With a ‘Buy’ rating and a price target of ₹275, Emkay expects shares of National Aluminium Co to surge up to 30%

Coal India offers attractive valuations following a recent pullback. A ‘Buy’ recommendation is upheld, with a target price of ₹600, indicating a 56% upside potential from the stock’s current levels.

Conversely, the brokerage maintains a ‘Sell’ rating on Hindalco, citing persistent challenges at Novelis. Emkay has a price target of ₹

600 on Hindalco.

Over a 10-year horizon, Godawari Power and Ispat, Jindal Steel And Power, and Nalco have delivered robust TSR of over 20% annually, while SAIL and Coal India have underperformed the Nifty 50’s TSR of 12.8%.

2025 — expectations, themes, and issues

Emkay Global sees five key themes for 2025:

1) Potential safeguard duty hike in steel – the market is expecting safeguard duties up to 25%. According to Emkay, there is a case for a hike, however, it sees a 25% duty as unlikely. There could possibly be a slow recalibration toward higher anti-dumping duties to contain inflationary effects.

2) Iron ore royalty regime – there would be more noise, however, the path to higher cost of production is clear.

3) Steel earnings trough – Emkay expects steel prices and earnings to trough and recover in 2025. The pace of price declines in China appears to have decelerated. The monetary policy shift to ‘moderately loose’ should act both as a downside cushion as well as a push for incremental recovery hereon. The direction of policy shift is favorable; effectiveness would be known only in hindsight.

4) Tight aluminium supply/demand – The brokerage expects alumina and bauxite supply squeeze to ease in Q1CY25, however, new normal prices could settle higher than 10-year averages due to market potentially remaining in a modest deficit.

5) Stricter regulations – Stricter regulations with continued sanctions on Russia could keep aluminium physical premiums elevated, supporting earnings resilience for non-ferrous names.