| Company | Value | Change | %Change |

|---|

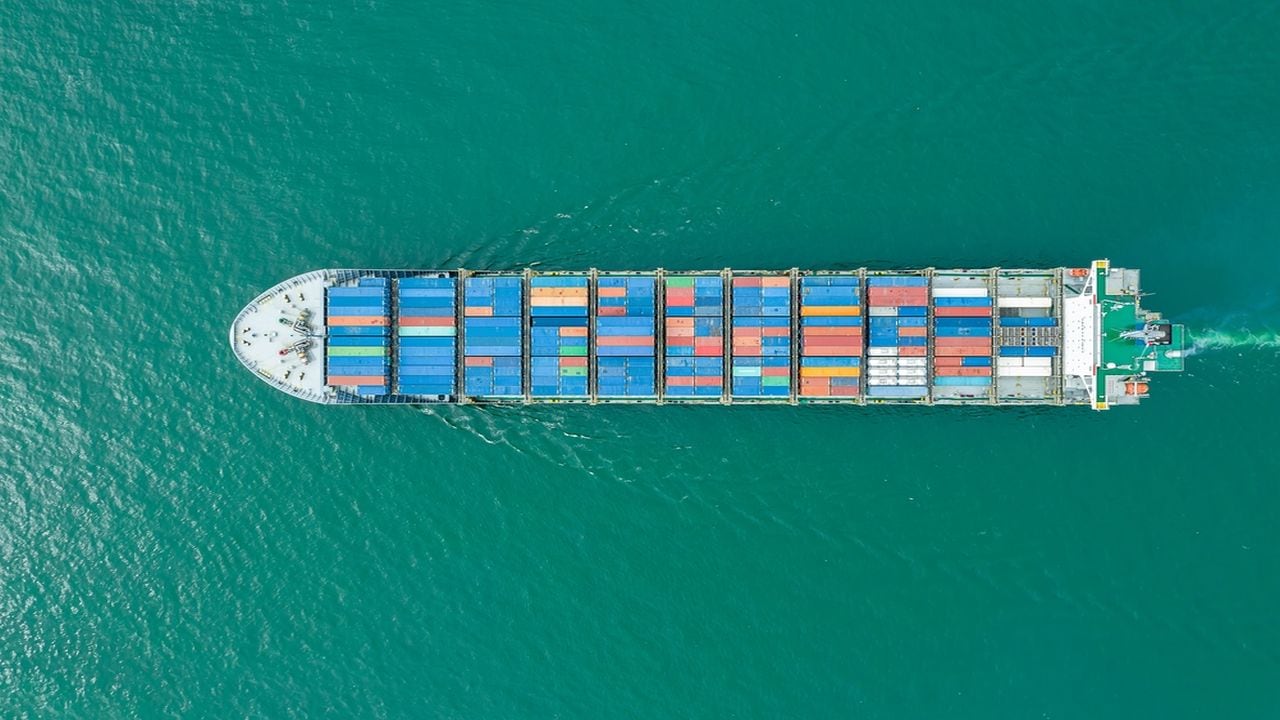

Merchandise exports grew by 2.17% year-on-year in the April to November period, but imports increased at a faster pace of 8.35%, further exacerbating the trade imbalance. In November, merchandise exports reached $32.11 billion, down from $39.2 billion in October, while imports surged to $69.95 billion from $66.34 billion the previous month.

A key factor in the declining export figures was a significant drop in petroleum product exports. The fall in petroleum exports was attributed to a decline in prices. Petroleum product exports dropped by 18.9% year-on-year between April and November 2024.

“An unprecedented fall in petroleum products prices has pulled down goods exports in November,” Commerce Secretary Sunil Barthwal explained. Despite this, non-petroleum exports showed growth, with figures reaching $28.40 billion in November, up from $26.30 billion in November 2023, reflecting strong demand driven by the festive and wedding seasons.

According to the ministry, India’s non-petroleum exports and services are expected to sustain strong performance in the final four months of the fiscal year. The country is also on track to surpass $800 billion in exports by a significant margin.

Commenting on rising imports, the ministry noted that India’s demand for goods is much higher than the global average. With the Indian economy growing at 7%, compared to the global growth rate of 3.5%, the country’s appetite for imports remains strong.

At the same time, demand for Indian exports has been relatively lower globally. However, as long as foreign direct investment (FDI) and exports continue to grow, they will help finance the country’s imports.

Some of India’s imports are also linked to exports, such as raw materials and intermediate goods, which are essential for its export-oriented industries.

Gold imports, however, surged to a record high of $14.8 billion in November, driven by strong investor demand. Gold imports for the period April to November 2024 rose by 49.08% compared to the same period in the previous year.

Factors contributing to this increase include rising gold prices, the reduction in customs duty from 15% to 6%, and growing demand during the festive season, wedding season, and amid geopolitical uncertainty.