| Company | Value | Change | %Change |

|---|

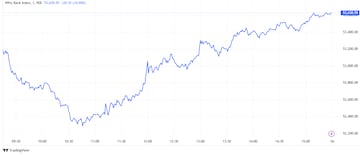

The Nifty recovered nearly 600 points from the lows of the day at 24,180 to end within touching distance of the higher end of the 24,500 – 24,800 range it found itself stuck in for the entire week before Friday. That came after a 350-plus points drop from the opening levels.

Friday’s swings were reminiscent of the weekly expiry session on December 5, when the Nifty, having made a low of 24,295, ended up recovering to levels above 24,850. Back then, Motilal Oswal’s Chandan Taparia spoke of extreme swings during the weekly expiry sessions and also warned of more such sessions going ahead. You can read more on that here.

The recovery on Friday has now put higher levels back in the spotlight. The December 5 high of 24,857 is the first level on the upside to watch out for, followed by the 25,000 mark, where there is still some resistance for the Nifty. For the week, the Nifty ended with gains of 0.4%, ending higher for the fourth week in a row, after nearly snapping a three-week winning run.

All eyes for the upcoming week will be on the US Federal Reserve’s policy decision, where a 25 basis points rate cut from Jerome Powell & Co. is almost a done deal, but the focus will be on the commentary for the road ahead as to where the FOMC sees the interest rates in 2025, particularly after Donald Trump takes office on January 20.

Foreign institutions were net buyers in the cash market on Friday, while domestic institutions were net sellers.

The market action of Friday indicates a strong comeback of the bulls and more upside is expected in the near-term, said Nagaraj Shetti of HDFC Securities. The next upside target for the upcoming week is 25,200 with immediate support at 24,650, he added.

Amol Athawale of Kotak Securities said that the Nifty not only reclaimed the 50-Day Simple Moving Average, but also formed a reversal formation on the daily charts, indicating further upside. For the positional traders, 24,400 will be a crucial zone, above which the bullish formation will continue. He sees potential upside up to 25,000 – 25,200 levels for the next week.

Similar to the Nifty, the Nifty Bank also recovered sharply from the lows of the day, jumping as much as 1,300 points to close above the mark of 53,500. It was a free fall for the Nifty Bank in the early minutes of trade once it broke below the 53,000 mark, but the index recovered soon in the second half and is now back close to crucial levels on the upside. However, despite the sharp recovery, the Nifty Bank ended as an underperformer for the week, ending with losses of over 0.5% and snapping a three-week winning streak in the process.

The Nifty Bank has seen a green weekly candle, reflecting renewed bullish momentum and buying interest at lower levels, said Om Mehra of SAMCO Securities. He said that 53,100 and 53,000 are key downside support zones at lower levels, while if 54,000 is crossed on the upside, it could lead to new record high levels.

What Are The F&O Cues Indicating?

These stocks saw addition of fresh long positions on Friday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| Paytm | 2.88% | 20.18% |

| MGL | 1.30% | 13.10% |

| Zomato | 0.66% | 11.53% |

| Max Health | 0.95% | 10.72% |

| Manappuram | 2.95% | 8.70% |

These stocks saw fresh short positions on Friday, meaning a decline in price but an increase in Open Interest:

| Stock | Price Change | OI Change |

| CAMS | -1.92% | 15.27% |

| Adani Green Energy | -1.87% | 14.06% |

| Poonawalla Fincorp | -2.85% | 13.33% |

| Adani Total Gas | -1.75% | 12.65% |

| CG Power | -1.74% | 11.14% |

Short covering was seen in these names on Friday, meaning an increase in price but a decline in Open Interest:

| Stock | Price Change | OI Change |

| Delhivery | 2.64% | -7.83% |

| IndiaMART | 1.75% | -5.52% |

| Axis Bank | 0.07% | -5.18% |

| IEX | 0.28% | -4.97% |

| Tata Elxsi | 0.51% | -4.71% |

Unwinding of long positions was seen in these stocks on Friday, meaning a decline in both price and Open Interest:

| Stock | Price Change | OI Change |

| Glenmark | -1.16% | -16.49% |

| NALCO | -1.86% | -6.49% |

| Muthoot Finance | -1.34% | -6.29% |

| KEI Industries | -1.74% | -5.91% |

| HUDCO | -1.34% | -5.36% |