| Company | Value | Change | %Change |

|---|

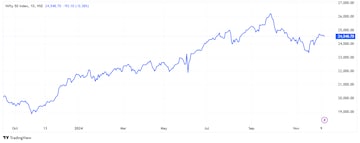

Weekly expiry related moves meant that the Nifty traded in a slightly broader 150-point range on Thursday, but there are two factors that the bulls would not appreciate. One being that the Nifty is back to the lower end of the range and the second being that the index closed at the lowest point of the day.

After 14 days of gains, both the Midcap and Smallcap indices saw some profit booking, ending the session lower as well.

The important CPI inflation data for November came in-line with expectations but it remains to be seen what would that do to reignite any positive sentiments in the market. Unlike the US, where an in-line inflation print sent rate-sensitives soaring as it all but confirmed a rate cut from the Fed next week, that is not the case in India.

Firstly, food inflation remains higher, despite the marginal decline seen in the actual number month-on-month. Secondly, the December quarter is coming to an end, earnings are around the corner, and some FMCG companies have already warned of margin pressures due to higher costs and lack of demand.

Levels remain the same for the Nifty as they have been throughout this week. While the index made a higher high and higher low on Wendesday, it resumed its lower high and lower low streak on Thursday. The index struggled to cross the previous day’s high and the low was well below Wednesday’s low. 24,550 continues to remain the key for the Nifty, followed by 24,500, which it has not broken below all through this week.

For the week, the Nifty is marginally lower and needs a close above 24,677 to ensure a weekly gain. The market will also react to announcements that have come from China post market hours and the reaction on Wall Street post a rise in jobless claims and a slightly hotter-than-expected Producer Price data.

Foreign institutions have resumed their selling spree in the cash market on Thursday, while domestic institutions were net buyers. The numbers though, could be skewed due to two large blocks that took place in Nuvama Wealth and Neuland Laboratories.

Chandan Taparia of Motilal Oswal said that the indices lack momentum in either direction currently but the Nifty is managing to hold on the all of its key short-term moving averagesand the key support of 24,500. An inside bar on the weekly chart indicates positive to range-bound bias for the coming sessions. Till the Nifty is above 24,350, he expects the buy-on-dips strategy to continue.

HDFC Securities’ Nagaraj Shetti said that any further dip from here will be a buy on dips opportunity as he expects a minor dip with rangebound action in the coming sessions. Immediate support is at 24,400 – 24,350 with intraday resistance at 24,700.

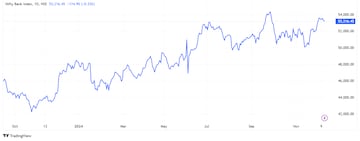

The Nifty Bank fell for the second day in a row and has now come off over 650 points from last week’s high of 53,888. The index has now declined in four out of the last five trading sessions. After three successive weeks of gaining 2% or more, the Nifty Bank is down 0.5% for the week so far. It requires a close above 53,509 to ensure a weekly gain and also close above an important level.

The Nifty Bank remains sideways with 53,150 – 53,100 continuing to act as an immediate support, while 53,600 – 53,700 is a resistance zone. To resume the upside, the Nifty Bank needs to break above the resistance zone and sustain, said Om Mehra of SAMCO Securities. On the slip side, a break below 53,100 can accelerate the selling pressure.

Hrishikesh Yedve of Asit C Mehta Investment Interrmediates said that the Nifty Bank has formed a doji, indicating uncertainty. The index can give a fresh move once the consolidation is over. He expects a consolidation between the 52,500 – 54,000 level for the short-term. He advises buying near support levels and booking profits between the 53,800 – 54,000 zone.

What Are The F&O Cues Indicating?

Fresh long positions were seen in these stocks on Thursday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| Delhivery | 0.81% | 37.14% |

| Max Health | 3.14% | 28.58% |

| Adani Total Gas | 0.28% | 27.29% |

| Adani Energy Solutions | 3.42% | 13.39% |

| Adani Green | 6.99% | 5.39% |

Fresh short positions were seen in these stocks on Thursday, meaning a decline in price but an increase in Open Interest:

| Stock | Price Change | OI Change |

| NALCO | -7.07% | 29.11% |

| IRFC | -1.67% | 22.55% |

| Tata Elxsi | -0.61% | 14.94% |

| KPIT Tech | -0.51% | 13.39% |

| Zomato | -2.30% | 9.28% |

Short covering was seen in these stocks on Thursday, meaning an increase in price but a decline in Open Interest:

| Stock | Price Change | OI Change |

| Macrotech | 1.31% | -10.01% |

| Manappuram Finance | 0.37% | -7.38% |

| L&T Tech | 1.25% | -5.95% |

| Glenmark | 0.17% | -5.90% |

| Shriram Finance | 0.17% | -5.11% |

These are the stocks to watch out for ahead of Friday’s trading session:

- Tata Motors: To increase the price of its commercial vehicles by up to 2% from January 2025.

- Hindustan Aeronautics: Ministry Of Defence signs contract worth ₹13,500 crore for procurement of 12 Su-30MKI Aircraft.

- Zomato: Gets tax demand worth ₹803 crore which includes tax and penalty for the period between October 2019 and March 2022.

- Greenply Industries: Closes manufacturing operations at the Vadodara-based MDF plant due to breakdown of machinery. Necessary steps being taken to resolve the issue. Production will resume in a few days.

- Nuvama Wealth: Edelweiss Financial Co & Ecap Equ sold 7.1% stake for ₹1,759 crore. Kotak Emerging Equity Scheme bought 2.7 lakh shares for ₹186 crore.

- JK Tyre: Secures loan worth €30 million to expand production capacities in Madhya Pradesh.

- JSW Energy: Thermal Power at Ratnagiri does not have any gas storage facility and facility not involved in recent incident of gas release as reported in the media.

- Bajel Projects: Wins order from Solapur Transmission for establishment of the new 400 / 220 kV Solapur substation.

- GR Infra: Gets LoI for a transmission project in Karnataka. The Quoted price for the project is at ₹107.7 crore per annum.

- Pennar Industries: To enter into a JV agreement with Zetwerk Manufacturing Businesses to manufacture and sell solar modules and cells.