| Company | Value | Change | %Change |

|---|

The revised price target from Goldman Sachs implies a potential downside of 17% from Wednesday’s closing levels.

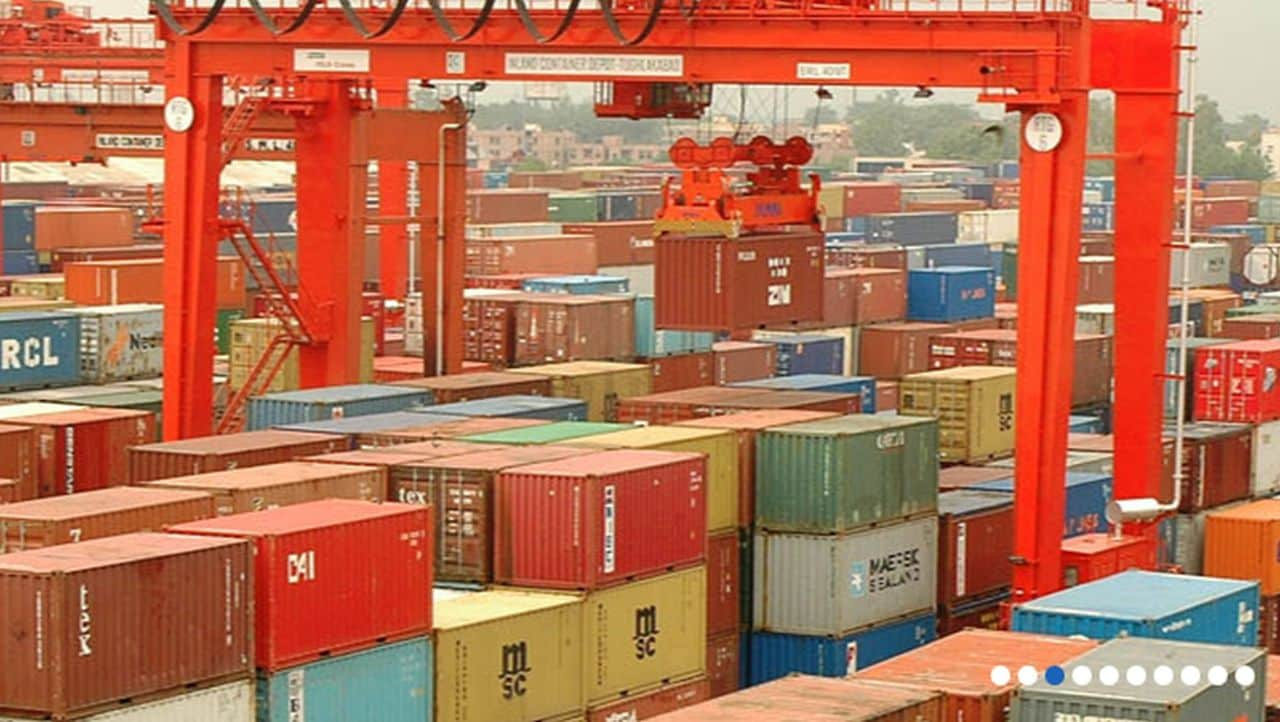

Goldman Sachs said that CONCOR’s earnings have further downside risk driven by weak growth for rail container traffic and market share concerns amidst rising competition.

CONCOR’s earnings downgrade cycle is likely to continue, according to Goldman Sachs, who sees further downside on the stock.

Shares of CONCOR have already corrected 27% from their recent peak of ₹1,180.

CONCOR’s first half volume growth of 6% year-on-year was weak, with a current run-rate of rail container traffic for October and November being similar, Goldman Sachs sees the company’s guidance to be “ambitious.”

CONCOR shares are currently trading at a financial year 2026 price-to-earnings multiple of 34 times and 20.5 times financial year 2026 Enterprise Value to EBITDA (EV/EBITDA) compared to its long-term median multiple of 18.5 times.

Out of the 24 analysts that have coverage on CONCOR, 13 of them have a “buy” recommendation on the stock, five say “hold”, while six of them have a “sell” rating on the state-run company.

Shares of CONCOR ended 0.5% higher on Wednesday at ₹856. The stock has been absolutely flat in 2024, currently down 0.6%.