| Company | Value | Change | %Change |

|---|

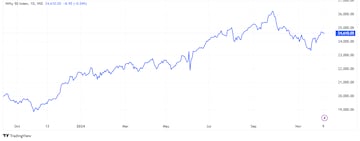

Tuesday was another session that belonged to consolidation or sideways movement for the Nifty. At one point though, it did feel as if Reliance Industries and the banking heavyweights barring ICICI Bank, would pull the Nifty down further, they even did, till levels of 24,500, but the bulls stepped in during the final 30 minutes to salvage the situation. The Nifty recovered nearly 100 points from the lows of the day to end at nearly the same levels as Monday, albeit just below the flat line.

Unlike the previous sessions, the broader markets did not outperform by a great deal, although the did end above the flat line with modest gains. However, similar to the earlier sessions, there was plenty of newsflow-driven, stock-specific activity that continued in the broader markets.

All eyes are now on the CPI print that comes both in India on Thursday and in the US on Wednesday. Wall Street had a cautious undertone on Monday ahead of the CPI data and the Indian markets too are exhibiting similar signs of caution ahead of the key data point, which may determine what will the new RBI Governor Sanjay Malhotra do in his first policy at the helm in February 2025.

Both foreign and domestic investors were net buyers in the cash market on Tuesday and it was yet another day when the foreign institutions outbought their domestic counterparts in the cash market by nearly double the amount.

Nagaraj Shetti of HDFC Securities has observed the formation of a bullish hammer pattern on the Nifty but not a classical one. Usually, such a formation signals impending trend reversal on the upside. He said that the next resistance to watch on the upside is between 24,850 – 24,900, while immediate support on the downside is at 24,500.

The Nifty bulls continue to hold the upper hand, as long as the 24,500 – 24,400 levels are held, making dips towards this range potential buying opportunities, said Rajesh Bhosale of Angel One. Resistance remains between 24,750 – 24,800 levels and a sustained move above that can take the index to levels of 25,000, he added.

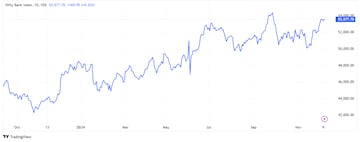

On similar lines to the Nifty, the Nifty Bank recovered during the final few minutes of the trading session and emerged as an outperformer in comparison to the Nifty. In fact, the index ended with gains of nearly 200 points. The Nifty Bank also closed above the mark of 53,500 and is now 900 points away from its earlier record high level of 54,467.

Hrishikesh Yedve of Asit C Mehta said that the Nifty Bank may have formed a green candle but it continues to face short-term resistance near the 53,900 – 54,000 mark. Only sustaining above the 54,000 level will take the index to 54,500 levels, which will be a new record high. Support for the index continues at the 52,500 mark.

What Are The F&O Cues Indicating?

Fresh long positions were seen in these stocks on Tuesday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| Cyient | 3.06% | 32.14% |

| Nykaa | 3.97% | 30.80% |

| KEI Industries | 1.57% | 24.22% |

| Glenmark | 2.22% | 21.74% |

| PB Fintech | 2.07% | 21.32% |

Fresh short positions were seen in these stocks on Tuesday, meaning a decline in price but an increase in Open Interest:

| Stock | Price Change | OI Change |

| IRB Infra | -1.34% | 76.95% |

| Sona BLW | -2.58% | 26.19% |

| CAMS | -1.01% | 16.23% |

| APL Apollo | -0.35% | 15.10% |

| HFCL | -2.52% | 15.05% |

Short covering was seen in these stocks on Tuesday, meaning a decline in Open Interest but an increase in price:

| Stock | Price Change | OI Change |

| Can Fin Homes | 1.99% | -13.01% |

| Syngene | 1.74% | -5.40% |

| IEX | 0.99% | -5.39% |

| RBL Bank | 4.08% | -5.01% |

| Manappuram | 2.40% | -3.83% |

These are the stocks to watch out for ahead of Wednesday’s trading session:

- Awfis Space Solutions: Bisque, Link Investment Trust and Peak XV Partners Investment likely to sell 12.2% stake via block deals. Floor price of ₹680 is a 5.2% discount to Tuesday’s close. Size of the deal said to be ₹583.4 crore. There will be a lock-in period of 90 days for further sale of shares.

- Syngene: Biocon confirms selling 80 lakh shares of the company via block deals on Tuesday worth ₹686 crore. Post this transaction, Biocon’s shareholding in Syngene stands at 52.46%.

- HG Infra: Gets Letter of Award from Road Ministry for project worth ₹763.1 crore.

- Indian Overseas Bank: Receives order of refund worth ₹1,359.29 crore from the Income Tax Department for annual year 2015-16.

- Ashiana Housing: DGGI conducts a search at the premises of its unit Treehouse Hotel Club & Spa, Bhiwadi on December 6. The company has made an interim payment of ₹1.5 crore for tax review

- Asian Granito: Signs JV Agreement with Shudh Investments & UK’s Klyn Stone. Also signs JV agreement to acquire shares of Klyn AGL.

- NTPC Green Energy: Bags order to set up Energy Storage System of 250 MW / 1,000 MWh from SECI.

- Morepen Labs: Launches “LightLife,” a weight management program designed for modern lifestyles.