Managing Director Vipul Mathur explained that the US market offers better profitability, with EBITDA (earnings before interest, taxes, depreciation, and amortisation) margins historically exceeding $200 per tonne, compared to $150 in Saudi Arabia and $100 in India.

The company’s US facility recently won two major contracts to supply HSAW-coated pipes for natural gas pipeline projects.

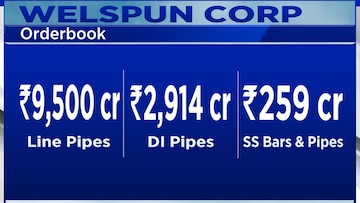

Welspun’s US order book now stands at ₹7,000 crore, representing 20–25% of the market.

These orders, finalised through a collaborative partnership model, are likely to deliver even better margins, according to Mathur.

He pointed to the positive impact of Trump’s first term, particularly in deregulating the oil and gas sector, and said a return of such policies could create a favourable environment for growth in the US market.

“The market looks very promising. Trump is back and he’s very pro oil, and we are seeing the traction happening into that particular market. I am sure that the next four years are going to be very bullish,” he said.

In India, Welspun is expanding into the pipe sector with an investment of ₹2,300 crore given that the segment has good growth potential.

The Ductile iron (DI) business, the Indian oil and gas business and the Indian water business are firing on all cylinders at this point in time.

Also Read | Welspun Corp Q2 Results: Net profit declines 26% amid market pressures, revenue plunges 18.6%

For more details, watch the accompanying video

Catch all the latest updates from the stock market here