Speaking to CNBC-TV18, Madhu Kela, Founder of MK Ventures, expressed bullish sentiments about its potential. Drawing comparisons with China’s Kweichow Moutai, the world’s most profitable alcohol company, Kela highlighted the untapped opportunities in India.

Kweichow Moutai’s current profitability of $12.5 billion dwarfs the combined profitability of Indian alco-bev companies, which stands at a mere $0.5 billion. This disparity underscores the immense growth potential within the Indian market. Interestingly, Moutai started at a similar profitability level 15 years ago before growing exponentially, indicating the transformative potential of the alco-bev industry when adequately leveraged.

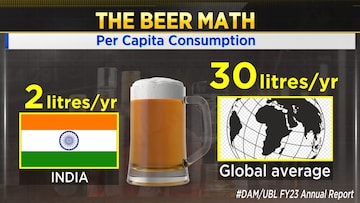

India is the world’s third-largest alco-bev market by volume, trailing only China and the United States. The market is projected to grow from ₹1,70,000 crore in FY15 to ₹5,00,000 crore by FY28. However, per capita consumption, particularly of beer, remains significantly lower than global standards, suggesting vast room for expansion.

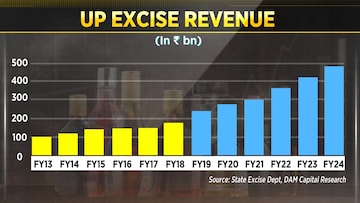

Structural and policy changes at the state levelthis growth trajectory are supporting. For instance, Uttar Pradesh’s 2018 liquor policy disrupted monopolistic distribution practices, spurring sales for organised players and boosting state excise revenues. Similarly, Andhra Pradesh’s focus on providing quality alcohol at reasonable prices sets benchmarks for other states, signalling a shift toward a more organised and growth-friendly framework.

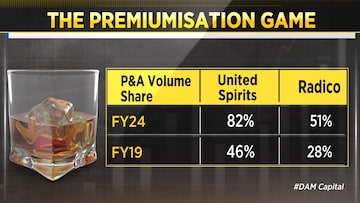

A key driver of growth in the Indian alco-bev industry is premiumisation—the shift towards higher-quality and higher-priced alcohol. Companies like United Spirits and Radico Khaitan have significantly increased the share of premium products in their portfolios. Additionally, Indian single malts are gaining popularity, surpassing imported single malts in consumer preference. This shift reflects the evolving tastes of Indian consumers and the growing demand for quality over quantity.

The ongoing wedding season, characterised by higher spending and more celebratory days, is providing a seasonal boost to alco-bev sales. Despite past contractions in gross margins for major players like United Spirits, Radico Khaitan, and United Breweries, there is optimism about a turnaround. Analysts at Dam Capital predict a margin expansion of approximately 250 basis points, driven by stable input costs (such as glass prices) and the premiumisation trend.

With robust demand and an industry-wide shift toward premium products, Indian alco-bev companies are poised for sustained growth.