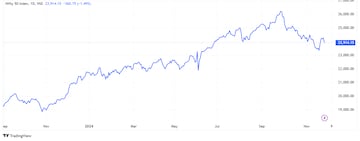

It was the same 24,350 mark that the index continues to find resistance at and Thursday was no different. The index made an intraday high of 24,345 during the first hour of the expiry session and reversed sharply post that.

Some would attribute the fall to the escalation of geopolitical tensions between Russia and Ukraine, some would say it was the expiry related volatility at play for the index, and some would call it routine retracement after a near-1,100-point recovery on the Nifty from last week’s low of 23,263. The reason may be either among the three, or a combination of the three, the bottomline was that the Nifty not only ended deep in the red, but also gave up the 24,000 mark on the downside, which was said to be a key near-term support.

Yet again, it was some concentrated selling seen in index heavyweights that contributed to the steep fall on the Nifty. Infosys, Reliance Industries, HDFC Bank, ICICI Bank and Mahindra & Mahindra, these five names contributed to 44% of the Nifty fall on Thursday. The concentrated selling was also evident as despite a 350-point drop on the Nifty, the broader markets still managed to do well comparatively. Both Nifty Midcap and Smallcap indices ended just above the flat line on Thursday, with PSU Banks continuing to outperform.

Friday’s trading session will not only mark the start of a new series, but will also lead to the introduction of 45 new names in the Futures & Options space, which includes three Adani Group companies, among other names like BSE, Angel One, CDSL, along with PSUs like IRFC, SJVN, Hudco and new age names like Paytm.

The Nifty ended the November series with losses of close to 300 points courtesy Thursday’s fall. A dramatic reversal last week though, limited the damage, which at one point was close to 1,000 points. Thursday’s fall has also meant that the Nifty has nearly erased all the gains for the week and is barely managing to hold on to the green on a weekly basis. The index needs to close above 23,907 for a positive weekly close.

There will be no overnight cues from Wall Street as the markets are shut due to the thanksgiving holiday. What the street will notice though is a potential ceasefire violation between Israel and Lebanon, just 24 hours after being put into effect.

Foreign institutions were heavy net sellers in the cash market, selling everything they purchased during the last three trading sessions, including the MSCI rebalancing. Domestic institutions remained net buyers.

Chandan Taparia of Motilal Oswal said that the Nifty has formed another bearish candle on the weekly charts, which signals further downside pressure can emerge if it fails to reclaim key resistance levels. Until the Nifty remains below the 24,350 mark, Taparia recommends selling every bounce for downside targets towards 23,600.

The weakness of Thursday could be a downward correction of the recent sharp upside bounce, said Nagaraj Shetti of HDFC Securities, who believes that the current weakness is a buying opportunity between 23,900 – 23,600 levels. A confirmation of a higher bottom reversal may open another round of upside bounce in the market, he added.

Kotak Securities’ Shrikant Chouhan said that the current market texture is weak and a techncial bounce back is possible only after 24,000 is reclaimed on the upside. Below that level, the Nifty is likely to test levels of 23,850 – 23,750 on the downside.

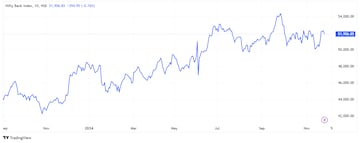

The Nifty Bank had a very wide 1,000 point range in Thursday’s trading session. The index retested levels of 52,800 on the upside, before a reversal and selling pressure in stocks like HDFC Bank, which earlier made a record high, and ICICI Bank led to the index testing levels of 51,750 on the downside as well. By close, the Nifty Bank closed below the mark of 52,000, just over 150 points off the lows of the session.

Om Mehra of SAMCO Securities noticed the formation of a bearish engulfing pattern on the daily chart, indicating caution, even as the Nifty Bank remains above the 20 and 50-Day Moving Average. Resistance on the upside is at 52,600, while the downside support is at 51,270.

The Nifty Bank has failed to cross the key barrier between 52,500 – 52,800 levels, said Hrishikesh Yedve of Asit C Mehta Investment Interrmediates. Immediate downside support is at 51,490, followed by 50,980. He advises booking profits on a bounce and await a sustained breakout above 52,600 levels on the Nifty Bank.

What Are The F&O Cues Indicating?

The December futures of these stocks saw addition of fresh long positions on Thursday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| Astral | 0.54% | 53.62% |

| IndiGo | 1.79% | 43.85% |

| GMR Airports Infra | 0.51% | 39.33% |

| CONCOR | 1.85% | 37.18% |

| GNFC | 2.40% | 34.58% |

Fresh short positions were seen in the December futures of these stocks on Thursday, meaning an increase in Open Interest but a decline in price:

| Stock | Price Change | OI Change |

| Glenmark | -1.50% | 64.36% |

| HDFC Life | -3.84% | 54.57% |

| Samvardhana Motherson | -1.22% | 50.68% |

| Dr. Lal Pathlabs | -1.70% | 44.20% |

| Max Financial Services | -4.24% | 40.58% |