Among sectors, energy indices outperformed, which rallied over 1.5%, whereas selective pharma and realty stocks witnessed some profit booking at higher levels.

Shares of Adani Group companies saw buying interest on clarification of ‘no FCPA’ charges. All Adani Group stocks closed with healthy gains, rising between 4% and 20%.

Ola Electric Mobility shares hit the upper circuit following new launches and a positive brokerage note.

Shares of NTPC Green Energy ended more than 12% higher after a modest stock market debut on November 27. The stock hit the 10% upper circuit during today’s morning trading session. At close, the stock quoted ₹121.65 per share on the NSE.

Market sentiment was further supported by easing geopolitical concerns, record highs on Wall Street, and a resumption of FPI inflows after two months of selling pressure. Additionally, minutes from the US Federal Reserve indicated optimism about easing inflation and a resilient labor market, fueling expectations of gradual interest rate cuts.

Looking ahead, investors await key US economic data releases later today, including the second estimate of Q3 GDP growth, PCE inflation data, and initial jobless claims, which are expected to influence market direction.

Thursday’s trading session will also mark the weekly expiry of the Nifty 50. Meanwhile, Wall Street and the US bond markets will be closed for Thanksgiving on Thursday.

With the Nifty trading with a positive bias, all eyes will be on FII data as the foreign investor exodus this November has already crossed ₹29,841 crore.

Both foreign and domestic institutions remained net buyers in the cash market on Wednesday.

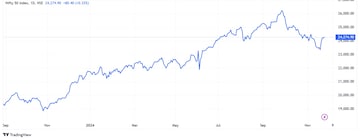

What do the Nifty50 charts indicate?

The range bound action continued in the market today and the Nifty closed the day higher by 80 points amidst choppy movement. After opening on a slightly negative note, the market made an attempt to move up in the mid part of the session. It was not able to surpass the intraday hurdle of 24,350 levels and consolidated towards the end.

According to Nagaraj Shetti of HDFC Securities, the opening upside gap of November 5 is still unfilled three days after its formation. He said that normally such unfilled upside gaps at the lows are indicative of bullish breakaway gap, which signal uptrend continuation for the underlying.

The near-term trend of the Nifty remains up with range bound action. As long as the Nifty continues with range bound movement, there is a higher possibility of a decisive upside breakout occurring in the near term. Immediate hurdles to be watched around 24,400-24,500 and the nearest support is placed at 24,150.

LKP Securities’ Rupak De said the Nifty has been consolidating over the past three days following a sharp upmove earlier. On the higher side, it faces resistance at 24,420; a decisive breakout above this level could trigger a significant move toward higher levels. On the lower side, support is positioned at 24,100.

De expects the index to stay range-bound until it makes a directional move on either side.

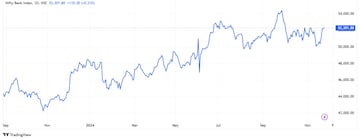

What do the Nifty Bank charts indicate?

A key highlight of Wednesday’s trading session was HDFC Bank entering uncharted territory, while the Nifty Bank opened with a gap up, witnessed profit booking, and settled the day on a flat note at 52,192 levels.

Further positive traction in this heavyweight stock and the banking index could propel the next leg of market momentum, making them vital to monitor, said Rajesh Bhosale of Angle One.

“Technically, the Bank Nifty failed to cross the major barrier of 52,500-52,580 and formed a bearish belt hold pattern, indicating weakness. As per this pattern, as long as index maintains below 52,580 weakness will continue. Thus, traders are advised to book profits and wait for a fresh breakout above 52,580,” said Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates.

These are the stocks to watch ahead of Thursday’s trading session:

Godrej Properties opens Qualified Institutions Placement (QIP) today, floor price at ₹2,727.44 per share.

HUDCO signs Memorandum of Understanding (MoU) with NBCC for development of 10 acres of land parcel in Noida.

Natco Pharma sells 14.38 acres of land in Ranga Reddy District, Telangana, for ₹115.57 crore.

Ashoka Buildcon bags order worth ₹192.69 crore from Madhya Pradesh Poorv Kshetra Vidyut Vitaran Company.