However, he cautions that inflation remains a significant hurdle. On the global front, Gambhir warns of US 10-year treasury yields potentially exceeding 5% and expects the rupee to remain under pressure, possibly hitting ₹87.5/$ by March.

The RBI has introduced a daily repo liquidity window worth ₹50,000 crore, which includes standalone primary dealers for the first time. This is a notable change from earlier policies, ensuring liquidity to market participants despite active forex interventions and shifts in government balances. “This move reassures markets of the RBI’s commitment to providing stable liquidity,” Gambhir said.

Also Read: RBI revives daily repos to stabilise liquidity and rupee

Mitul Kotecha, Head of Fx and EM Macro Strategy Asia at Barclays expects the US Federal Reserve to cut rates in June. However, with the US labour market remaining strong, he predicts any recovery in the rupee will be short-lived.

Both Gambhir and Kotecha anticipate heightened market volatility in the coming months, with strong capital flows likely pushing the US Dollar Index (DXY) higher.

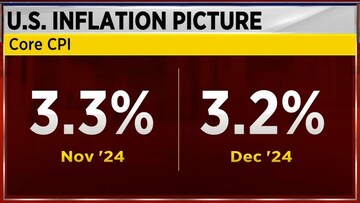

Kotecha also highlighted the risks tied to US treasury yields, stating they could rise above 5% despite a recent drop following consumer price index (CPI) data. Factors such as higher real rates, term premiums, and uncertainties around inflation and growth contribute to this risk.

For more details, watch the accompanying video