In an interview with CNBC-TV18, he said that by combining their expertise in body electronics with Flash’s powertrain and engine electronics, Minda aims to offer comprehensive system solutions to all EV manufacturers in India, covering everything from two-wheelers to passenger vehicles.

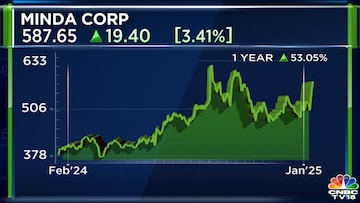

Minda Corporation, an automotive parts maker, has a market capitalisation of about ₹14,104.49 crore, with its share price rising by almost 54% in the past year.

This is the verbatim transcript of the interview.

Q: Tell us about the funding of ₹1,370 crore odd you have to come up with. Also, what is your current debt level?

A: We are back with something historic for Minda Corporation. We have formed a strategic partnership with Flash Electronics to create the fastest electric vehicle (EV) growing platform in the country.

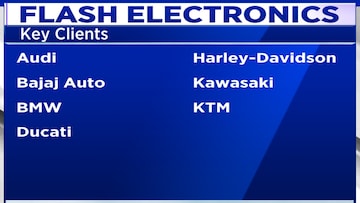

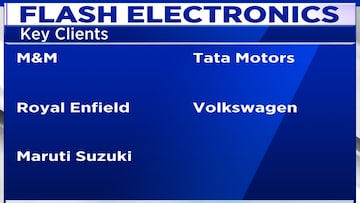

I would first like to share about Flash Electronics. It is an organisation which is based out of Pune and has focused on EV and internal combustion engine (ICE) and powertrain electronics, while Minda Corporation also focuses on the powertrain side of the EV products, but we have body electronics, such as instrument clusters, keyless solutions, wiring harness and other product lines.

Also Read: Minda Corporation acquires 49% stake in Flash Electronics for ₹1,372 crore, shares jump 5.5%

Going forward, as a part of the strategic partnership we will be acquiring a 49% stake for ₹1,372 crore and this will be value creative for Minda Corporation shareholders, as we will be creating a lot of synergies from the way of cross-selling to the captive requirement of Flash Electronics, as well as adding new customers and exports, which is the growth for us.

Also, the share of profit that will be coming in Minda Corporation will be additional from 2025-26 (FY26) as well as for the funding side, growing in the short-term, the net debt to equity will be about 0.6 times, which is well within the comfortable interim limits of Minda Corporation financial prudence and the net debt to performa net earnings before interest, taxes, depreciation, and amortisation (EBITDA) is about 1.8 times.

Q: What is the existing debt on books and what will it be after this acquisition?

A: In the short term, we will be looking at about 0.6 times our debt to equity. Going forward, we have a lot of opportunities and options to fine-tune our long-term perspective of the financial positions.

Q: Will you raise any equity?

A: There are various options that we will continue to evaluate, and we will come back to the market as we decide.

Q: Why 49% stake and not 51%?

A: We believe at Minda Corporation, it will be an era of partnerships and collaborations going forward. Also, we believe that creating value together is in the best interest of all stakeholders.

Q: Is there an option to acquire a majority?

A: As of now, it is 49%. We will continue to explore how we can collaborate and work together.

Q: What can we expect in terms of revenues from this partnership?

A: As the synergies for the captive consumption of Flash, we are looking at from, let’s say, about 18 to 24 months from now on, about ₹100 crore plus, and going to about ₹600-700 crore by 2029 and 2030; just by the captive requirements in the areas of die casting products, wiring harness and other electronics that are synergistic to Minda Corporation.

Also, this will become more competitive for Flash as well as Minda to acquire more customers and more product lines. Third, the very important lever is adding new customers as well as the export market that will open up for Minda, where we can add new products to our new customers coming from Flash Electronics.

Q: Repeat the numbers for us.

A: In 18-24 months, we are looking at about ₹100-200 crore, as per our business plan, and by 2030 just by organic captive consumption, we look to expand this to about ₹500-600 crore.

Q: This is what you selling to Flash?

A: That is right.

Q: You are buying 49% of a company to be able to sell to them? Am I understanding it correctly?

A: No, the more important idea is to create the largest EV platform in the country. So, while we are into the body electronics and Flash is in the powertrain and engine electronics, we will be offering a complete system solution, which is offered by none other in the country, to all the E-Wheeler manufacturers in India, whether it is two-wheelers, commercial vehicles, three-wheelers, as well as passenger vehicles. That is the idea of how we can combine and cross-sell our products as a system solution offering to the end customers, which are the original equipment manufacturers (OEMs) for us.

For the entire interview, watch the accompanying video