He explained that replacing this project with new ones would take time since some of the new deals were finalised only towards the end of the October-December 2024 quarter (Q3FY25).

Also Read | HCLTech Q3 shares among top Nifty 50 losers post 9% fall

As a result, the benefits of these deals are expected to become visible in the latter part of the January-March 2025 (Q4FY25) quarter and continue into April-June 2025 (Q1FY26).

CFO Shiv Walia said HCLTech plans to significantly increase its fresher hiring next year. However, the focus will be on recruiting people with specialised skills rather than on large numbers.

HCLTech’s market capitalisation is currently at ₹4,95,393.13 crore, and its shares have risen by nearly 15% over the past year.

This is the verbatim transcript of the interview.

Q: Tell us more about the company’s decision to not raise the organic growth guidance.

Vijayakumar: Our earlier guidance was 3.5-5%. Now we raised the upper end of the guidance from 3.5% to 4.5%. So, the new guidance is 4.5-5%. So, half a percent increase in the lower end is due to the organic improvement, and half a percent is through the contribution from Hewlett Packard Enterprise’s (HPE) Communications Technology Group (CTG) asset that we acquired. So overall, it’s 4.5-5%.

Q: But the asking rate for January-March 2025 (Q4FY25) is minus 1.3 to plus 0.6% which means you are not expecting any pickup, even if you account for the reduction in seasonality in your products business.

Vijayakumar: The software business will have a big seasonality. We had a big peak in December and now that will come off in the January-March 2025 (Q4FY25) quarter. Our momentum across all the verticals is continuing to pick up, and there will be some impact because of a large programme coming to an end in the retail CPG segment, where we had a 14% sequential growth last quarter.

Now, to backfill that project with new projects, will take some time because some of the deal wins have happened towards the end of the October-December 2024 (Q3FY25) quarter, so that pickup will happen towards the second half of the March quarter, and that will continue into the April-June 2025 (Q1FY26).

Q: What would be the loss in Q4FY25 because of the large retail consumer packaged goods (CPG) programme coming to an end?

Vijayakumar: I think that will be roughly $30 million.

Q: In the current quarter. You also spoke about some delays in signing certain large deals and renewals. Can you tell us a little bit more? Was it one specific deal, or is it a little broader-based, and what is happening in the client corporate conversations now?

Vijayakumar: Overall a lot of conversation on good interest in using generative artificial intelligence (AI) for both innovation and efficiency, and that is directly leading to a lot of conversations on data application modernisation. Some more cloud migration and transformation kind of opportunities. So, the conversations are getting a little more productive in terms of good programmes that could materialise for us.

Also Read | HCL Tech shares fall most in over nine years

We saw that at the end of September as well. We did indicate there are some green shoots of growth in financial services and tech as well, we saw some improvements, and that is reflected already in our broad-based growth in Q2FY25 and Q3FY25. Now, in Q4FY25 as well, across most verticals, we will grow except some of the specific things that I called out will have an impact in Q4FY25.

Q: In Q4FY25, all verticals should grow ex of retail and CPG?

Vijayakumar: It would be broader-based; some could be flattish. And the way you should interpret this is every vertical has some dynamics that play into every quarter. But are the new additions adequate to offset some of those reductions is what we should see? We are quite positive about an all-around growth in Q4FY25.

Also Read | HCL Tech declares interim dividend of ₹12 and a special dividend

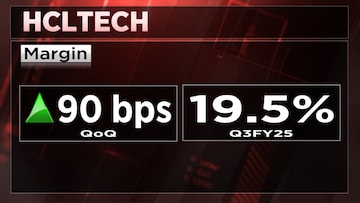

Q: In Q4FY25, typically you have the wage hikes for senior management. So Q4 margin should be lower than Q3FY25 and what would be the impact of hikes?

Walia: As we announced last quarter also, the impact is going to be somewhere between 50-60 basis points. Yes, the margins in Q4FY25 are going to be slightly lower than Q3 because Q3 has an impact on the seasonality of the software. That is the only variation I can see. Otherwise, the rest should be.

Q: What is the outlook on hiring for calendar year 2025, or January-March 2025 (Q4FY25), and the view on attrition? Is attrition going up, or is it going down? What is the visibility?

Walia: This quarter we hired around 2,000 freshers and added, at a company level, over 2,200 or so, and for the next quarter, the plan is to add another 1,000 freshers. And given the uptick in the situation, we would increase our fresher intake substantially, but it is going to be specialized skill hiring than the numbers and that is the plan we have for next year.

For more details, watch the accompanying video