| Company | Value | Change | %Change |

|---|

The inkling of how Monday’s session may transpire was evident from Friday itself. We at CNBC-TV18 highlighted this morning as to how the Indian equities have multiple headwinds to tackle going into the new week. Those ranged from the sell-off on Wall Street, triggered by a hotter-than-expected jobs report, the resultant spike in treasury yields, a US Dollar that continues to get stronger and oil prices that are back on the boil.

All of that translated into pressure on the Indian rupee, which fell to a record low of 86.59, and consequently on the Equity markets.

Add to that was a close below key technical levels on Friday and there was the perfect recipe of a storm. The Nifty somehow managed to defend 23,000 on the downside, but with less than 100 points separating that mark from Monday’s closing, one can only wonder for how long is that possible.

The real pain was felt in the broader markets on Friday and Monday was an extension of that. Both the Midcap and Smallcap indices fell 4% each on Monday with multiple stocks now having corrected between 20% to 40% from their peaks. In just the last six trading sessions, the Midcap index is down 9%, while the Smallcap index has gone one better, declining 11%.

The horrors seen in the broader markets were evident from the Advance-Decline Ratio on Monday, where only 189 stocks on the NSE advanced, while 2,220 stocks ended in the red, that is 11 stocks declining for every one stock that gained.

Not only the frontline indices, sectoral indices too are in a deep shade of red from their respective record high levels. The Realty index is down over 20% from its peak in June, while the PSU Bank index, which also topped in June last year, is down 26%.

With Monday’s drop, the Nifty has given up all the gains it saw post the Lok Sabha election results. The closing levels on June 3 was 23,260, which incidentally also happens to be the November low from which the index had staged a rebound to 24,800 before embarking on this recent leg of selling.

Foreign institutions continued to remain net sellers in the cash market on Monday, while domestic institutions were net buyers.

Nagaraj Shetti of HDFC Securities said that the underlying trend of the Nifty remains weak and index is now headed lower towards its next support zone between 22,800 – 22,700 levels. Any pullback towards 23,350 could be a selling opportunity, he added.

The Nifty closing below its previous swing low indicates increasing bearishness, said Rupak De of LKP Securities. He said that 23,000 is a key level to watch and sustaining above that for a few sessions could indicate a potential recovery. On the flip side, a fall below that level may trigger a deeper correction.

Kotak Securities’ Shrikant Chouhan said that the Nifty is forming lower highs and also made a red candle on the daily chart, indicating further weakness. As long as the Nifty remains below 23,260, Chouhan expects the Nifty to fall to 22,900 – 22,800 levels. Only a move above 23,260 can take the index back to 23,400 – 23,450 levels.

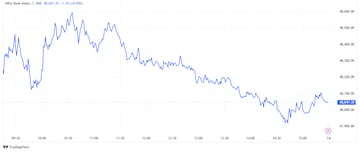

The Nifty Bank has been a bigger underperformer in comparison to the Nifty, and has now declined over 13% from its peak. In absolute terms, it is down over 6,000 points from the record high levels of 54,467. The index shed another 700 points on Monday after a 4.5% drop last week. The only solace, if one wants to consider it as that, is the fact that it managed to defend levels of 48,000 after slipping below it intraday.

The Nifty Bank has remained below its 250-Day Simple Moving Average near 49,900 levels and has also formed a red candle on the daily scale, indicating weakness, said Hrishikesh Yedve of Asit C Mehta Investment Interrmediates. On the downside, the 100-Week Exponential Moving Average is near 47,300 levels, which will now act as a key support for the index. He advises a sell-on-rallies strategy till the Nifty Bank remains below 49,900.

What Are The F&O Cues Indicating?

Fresh short positions were seen in these stocks on Monday, meaning a decline in price but an increase in Open Interest:

| Stock | Price Change | OI Change |

| KEI Industries | -5.32% | 27.53% |

| Nykaa | -3.74% | 22.17% |

| Paytm | -7.24% | 21.97% |

| Adani Total Gas | -9.03% | 18.11% |

| Angel One | -4.13% | 17.82% |

Unwinding of long positions was seen in these stocks on Monday, meaning a decline in both price and Open Interest:

| Stock | Price Change | OI Change |

| HFCL | -7.30% | -4.90% |

| Laurus Labs | -4.16% | -4.23% |

| NMDC | -4.52% | -3.51% |

| Bandhan Bank | -4.69% | -5.51% |

| RBL Bank | -2.94% | -3.21% |

Here are the stocks to watch ahead of Tuesday’s trading session:

HCLTech | IT company reported a 5.54% growth in consolidated net profit to ₹4,591 crore for the December quarter of the 2024-25 financial year. It had reported a profit of ₹4,350 crore in the year-ago period, according to a regulatory filing. Revenue from operations for the quarter under review came in at ₹29,890 crore, 5.07% higher than ₹28,446 crore in Q3 FY24. Sequentially, profit and revenue rose 8.4% and 3.56%, respectively.

United Spirits | Hina Nagarajan resigns as the MD and CEO of the company, with effect from March 31, 2025 and appointed Praveen Someshwar as the MD and CEO of the company, with effect from April 1, 2025.

JSW Energy | The company said it has been declared the successful applicant for the resolution plan submitted for KSK Mahanadi Power Company Ltd (KMPCL) under the corporate insolvency resolution process (CIRP) of the Insolvency and Bankruptcy Code, 2016. The company received a letter of intent (LoI) from the resolution professional, following the approval of the resolution plan by the Committee of Creditors.

Quess Corp | Business services provider announced the receipt of an income tax refund order for the assessment year 2017-18. The order, issued by the Deputy Commissioner of Income Tax under Section 154 of the Income Tax Act, 1961, confirms a refundable amount, including interest, totalling ₹20.74 crore. The company received the order today, January 13, 2025.

Angel One | Brokerage firm reported an 8.1% year-on-year (YoY) increase in net profit at ₹281.4 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal, Angel One posted a net profit of ₹260.4 crore. Revenue from operations rose 19.2% to ₹1,262.2 crore against ₹1,059 crore in the year-ago period.

Delta Corp | Online gaming firm reported a 3.5% year-on-year (YoY) rise in net profit at ₹35.7 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal, Delta Corp posted a net profit of ₹34.5 crore, the company said in a regulatory filing. Revenue from operations dipped 7.5% to ₹194.3 crore against ₹210.1 crore in the year-ago period.

Anand Rathi Wealth | Non-bank wealth solutions company reported a 33.3% year-on-year (YoY) increase in net profit at ₹77.3 crore for the third quarter that ended December 31, 2024. In the corresponding quarter of the previous fiscal, Anand Rathi Wealth posted a net profit of ₹58 crore, the company said in a regulatory filing. The company’s revenue from operations increased 29.9% to ₹237 crore against ₹182.4 crore in the year-ago period.