Index Fund Corner

Sponsored

| Scheme Name | 1-Year Return | Invest Now | Fund Category | Expense Ratio |

|---|---|---|---|---|

| Axis Nifty 50 Index Fund | +32.80% | Invest Now | Equity: Large Cap | 0.12% |

| Axis Nifty 100 Index Fund | +38.59% | Invest Now | Equity: Large Cap | 0.21% |

| Axis Nifty Next 50 Index Fund | +71.83% | Invest Now | Equity: Large Cap | 0.25% |

| Axis Nifty 500 Index Fund | — | Invest Now | Equity: Flexi Cap | 0.10% |

| Axis Nifty Midcap 50 Index Fund | +46.03% | Invest Now | Equity: Mid Cap | 0.28% |

Here’s a step-by-step guide to help you calculate your income tax under both regimes.

Understanding the tax slabs

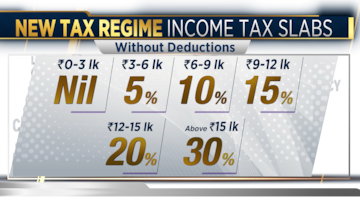

The new tax regime, introduced as a simplified alternative, features lower tax rates but offers minimal deductions.

The standard deduction, a fixed deduction from taxable income under the ‘salaries’ category, requires no additional disclosures or proofs of investment for taxpayers to benefit from it.

Here are the tax slabs under this regime:

A major benefit under this regime is a standard deduction of ₹75,000.

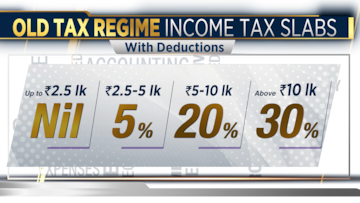

On the other hand, the old tax regime provides higher tax rates but allows taxpayers to claim several exemptions and deductions.

Here are the slabs:

Additionally, under the old regime, taxpayers with income up to ₹5 lakh can claim a rebate of ₹12,500 under Section 87A, nullifying their tax liability.

How to calculate your income tax?

Step 1: Calculate your gross income

The first step in calculating your income tax is determining your gross income. Gross income is the total income earned before applying any taxes or deductions. It includes:

– Salary components: This includes your House Rent Allowance (HRA), Leave Travel Allowance (LTA), and any special allowances such as reimbursements or food coupons.

– Other sources of income: Examples include interest earned from savings accounts, rental income from properties, or any freelance earnings.

To make things simple for taxpayers, the Income Tax Act of 1961, has divided these different sources of income into five heads.

Exemptions under HRA

If you live in rented accommodation and receive HRA as part of your salary, a portion of it can be tax-exempt. The exemption amount is the lowest of the following:

1. Actual rent paid minus 10% of your basic salary.

2. HRA received from your employer.

3. 50% of basic salary (for those living in metro cities) or 40% (for non-metro cities).

For Example:

– Basic monthly salary: ₹50,000.

– Rent paid: ₹20,000.

– HRA received: ₹15,000.

Calculation:

– Actual rent paid – 10% of basic salary: ₹20,000 – ₹5,000 = ₹15,000.

– HRA provided: ₹15,000.

– 50% of basic salary (metro city): ₹25,000

The HRA exemption will be ₹15,000, as it is the lowest of the three amounts.

Step 2: Subtract exemptions and deductions

Once you have your gross income, the next step is to reduce it by applying eligible exemptions and deductions.

Standard Deduction

– Old regime: A standard deduction of ₹50,000 is available.

– New regime: A higher standard deduction of ₹75,000 is provided.

Also Read: How to claim deductions for expenses related to children’s education

Section 80C deductions

Investments and payments under Section 80C can reduce your taxable income by up to ₹1.5 lakh. One can avail themselves of the deduction under section 80C if they opt for the old tax regime. However, an individual who chooses the new tax regime is not eligible to avail of the deduction.

Common examples include:

– Public Provident Fund (PPF)

– Employees’ Provident Fund (EPF)

– Equity-Linked Savings Schemes (ELSS)

– Life insurance premiums

Additional deductions

– Section 80CCD(1): Contributions to the National Pension Scheme (NPS) allow deductions of up to ₹50,000.

– Section 80D: Health insurance premiums are eligible for deduction, with limits varying based on the insured individual’s age.

– Section 80TTA: Interest earned on savings accounts (up to ₹10,000) can be claimed as a deduction.

Step 3: Determine taxable income

Taxable income is the amount left after subtracting all exemptions and deductions from your gross income. For example, if your gross income is ₹10 lakh and your total deductions (including Section 80C and HRA exemptions) are ₹2 lakh, your taxable income will be ₹8 lakh.

Step 4: Apply the tax slabs

Based on your taxable income and the tax regime you choose, calculate your tax liability by applying the relevant tax slabs. For instance:

– Under the new regime, ₹3 lakh of your taxable income will not be taxed, while the next ₹7 lakh will attract a 5% tax.

– Under the old regime, the calculation changes depending on deductions claimed and higher tax rates for various slabs.

Step 5: Add cess and surcharge

The final step involves adding cess and surcharge to your calculated tax liability. A surcharge is applicable to those persons whose income is more than ₹50 lakh. It applies to the tax payable and not the total income. Cess, on the other hand, is a levy and a form of tax imposed on income tax to raise funds for specific purposes such as health and education.

– Health and education cess: A flat 4% of the tax liability.

– Surcharge: Applicable for high-income earners:

– 10% for incomes between ₹50 lakh and ₹1 crore.

– 15% for incomes between ₹1 crore and ₹2 crore.

Example of tax calculation

A taxpayer with a gross income of ₹15 lakh and net taxable income of ₹9.85 lakh.

Old Tax Regime:

– Tax for ₹2.5 lakh to ₹5 lakh at 5% = ₹12,500.

– Tax for ₹5 lakh to ₹9.85 lakh at 20% = ₹97,000.

– Total tax = ₹1,09,500 + cess (4%) = ₹1,13,880.

New Tax Regime:

– Tax for ₹3 lakh to ₹7 lakh at 5% = ₹20,000.

– Tax for ₹7 lakh to ₹9.85 lakh at 10% = ₹28,500.

– Total tax = ₹48,500 + cess (4%) = ₹50,440.

Also Read: What happens if you don’t pay tax in India: A look at consequences of non-compliance