“The government must nudge global players selling in India to look at India as a base for manufacturing,” he said adding that this could be faster and more effective than additional PLI schemes.

Sampath welcomed the proposed ₹25,000 crore production linked incentive (PLI) scheme for electronics components, such as Printed Circuit Boards (PCBs) and camera modules, noting its potential to help India gain a stronger foothold in global markets.

However, he highlighted that boosting demand for Indian-made products, particularly in emerging sectors like electronics and high-tech manufacturing, could have an even greater impact.

He views Tata Electronics acquiring a majority stake in Pegatron India as a positive sign for the industry as increasing participation from Indian companies will reduce the dominance of foreign players and boost India’s position as a global manufacturing hub.

Also Read | Why did shares of Dixon Technologies, CG Power and peers witness a sharp fall?

The presence of world-class players attracts more attention from original equipment manufacturers (OEMs), enhancing India’s appeal for investment and growth across sectors.

Pricing pressure depends on the balance between demand and supply. In India, the demand for indigenously manufactured electronics exceeds supply, especially in advanced areas like semiconductors. As a result, margin pressures are minimal in such sectors.

Also Read | ‘Let the 90 hour week start from the top’, says Rajiv Bajaj

Pricing challenges are less about the number of players and more about the industry’s supply-demand dynamics.

India’s electronics sector is at the early stages of a growth revolution, with significant potential across both consumer and industrial areas where penetration remains low. Companies should focus on projecting future demand positively, as the industry is poised for aggressive growth despite current slowdowns.

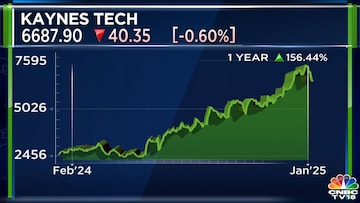

The current market capitalisation of this Karnataka-based company is ₹42,095.08 crore.

For more details, watch the accompanying video

Catch all the latest updates from the stock market here