The benchmark Nifty50 gained nearly 9% in 2024, extending gains for the ninth consecutive year. Although the broader market outperformed the benchmark index, there were some laggards too in the year gone by. A slowdown in loan growth and increased credit costs put pressure on shadow lenders.

Spandana Sphoorty Financial | Shares of Spandana Sphoorty Financial have lost nearly three-fourths of their value in 2024. As a result, the stock of the microfinance firm top the list of poorly fared stocks during the year. The microfinance firm reported wider-than expected loss of ₹200 crore in September quarter due to higher slippages.

Fusion Finance | Higher credit cost impacted the bottom-line of Fusion Finance as well. The Delhi-based microfinance firm posted a net loss of ₹305 crore in September quarter against a loss of ₹36 crore in the quarter ended June 2024. After rallying over 58% in 2023, shares of Fusion Finance slumped 69% in 2024.

Zee Entertainment Enterprise | The stock of Zee Entertainment more than halved to ₹121.29 from ₹274.70 quoted in 2023. The loss in Zee shares were the largest in 16 years, where the company had faced multiple headwinds including weak financials, governance and litigation outcomes. However, post the termination of the merger between Zee and Sony, the company has commenced many strategic initiative to restore growth and enhance margins.

HMA Agro Industries | Shares of recently listed HMA Agro Industries have declined 53% in 2024. The exporter of frozen buffalo meat products made its Dalal Street debut in July 2023 and saw its market valuation surging to ₹4,206 crore in December 2023.

Sanghi Industries | Sanghi Industries saw its share price decline by 52% in 2024 – for the first time in last four years. In 2023, Ambuja Cements, owned by Adani Group acquired majority stake in Sanghi Industries at an enterprise value of ₹5,190 crore. The acquisition of Sanghi Industries and Penna Cement Industries strengthen Adani group’s presence in cement sector, making the ports-to-power group the country’s second-largest producer of the construction material.

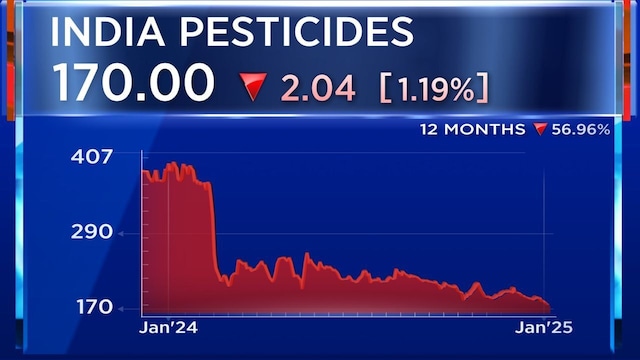

India Pesticides | Since its listing, shares of India Pesticides ended in the green only in 2023. While the stock declined 51% in 2024, it had lost 22% in 2022. On the flip side, shares of agricultural chemicals manufacturer surged 45% in 2023. The net profit of the company also plunged 58% to ₹60 crore in FY24 on the back of 23% decline in net revenue, which stood at ₹680 crore.

Vodafone Idea | After more than doubling in 2023, shares of Vodafone Idea lost half of the gain in 2024. The telecom stock came under pressure during the year after the Supreme Court rejected its plea on re-computation of adjusted gross revenues (AGR). However, later in December, the government waived Vodafone’s requirement for bank guarantees on payment shortfalls toward past spectrum auctions.

Arman Financial Services | Shares of Arman Financial Services yielded negative return of 49% in 2024 – its first yearly loss since listing. The financial service firm has been facing some pressure with regard to collections. However, collections have gradually improved in the middle of the year, which stood 97%. The consolidated AUM of the company as of March 2024 stood at Rs 2,639 crore.

Creditaccess Grameen | The stock of CreditAccess Grameen has declined by 44% in 2024. The stock of microfinance firm had returned 74% and 53% respectively in 2023 and 2022. During the Septmber quarter, the net profit of CreditAccess Grameen declined by 53% to ₹186 crore. Asset quality worsened led by impact on microloan collections result in increased GNPA ratio at 2.44%

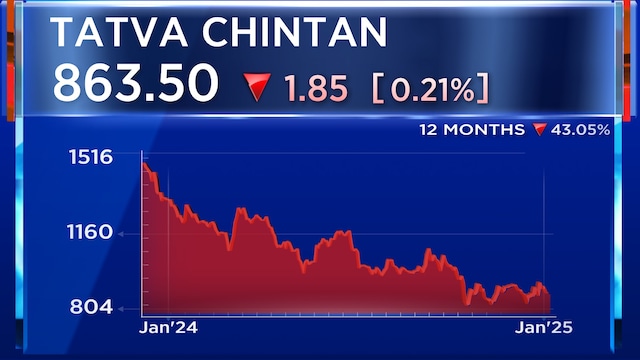

Tatva Chintan Pharma Chem | Shares of Tatva Chintan Pharma Chem extended their fall for the third year in 2024, having lost 44% of their value. The chemical producer has been generating negative returns since its listing in 2021. The Gujarat-based company went public in July 2021, with an offer price of ₹1,083 per share. Even though the stock more than doubled on listing, it failed to keep the upward momentum, closing Wednesday’s session at ₹881.50 on the NSE.