Bitcoin price crossed $93,000 on November 14, and has cooled off to a little over $90,000 since.

Billionaires who went from crypto haters to backers

“I am not a fan of Bitcoin and other cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air,” Donald Trump said on July 12, 2019, on X, the social media platform that was called Twitter at the time. In 2021 Trump warned that cryptocurrencies were a “disaster waiting to happen”.

Fast forward to 2024, Trump’s views have taken a sharp U-turn, and so have the fortunes of crypto enthusiasts. The President-elect in the US accepted campaign donations in cryptocurrencies and even launched a company. “I’m laying out my plan to ensure that the United States will be the crypto capital of the planet and the Bitcoin superpower of the world, and we’ll get it done,” he added.

Trump is not the only one who has gone from a sceptic to a fan of cryptocurrencies. Jamie Dimon once described Bitcoin as akin to a pet rock that does nothing but, as of filings in May 2024, JP Morgan, the investment bank he leads, reportedly has nearly $760,000 in spot Bitcoin exchange-traded funds on behalf of its clients.

Carl Icahn, Mark Cuban and other venture investors have also changed their minds over the years. While Warren Buffett’s personal stance wasn’t very pro-crypto, his firm Berkshire Hathaway has reportedly gained millions from its investment in a Brazilian fintech firm, Nu Holdings, which enables crypto trading.

Buffett’s firm has invested about $750 million since 2022, and the stock doubled in 2023 and added another 72% in 2024.

In 2020, Michael Saylor, the co-founder of Virginia, US-based MicroStrategy, decided to use Bitcoin as a hedge against inflation. Today, the company’s Bitcoin holdings are reportedly worth $26 billion, more than the liquid assets including cash held by giants like Apple, IBM, and Nike.

The price of Bitcoin has gone up 700% since 2020 and that of MicroStrategy shares is up over 26 times in the same period, according to a Bloomberg report.

The Elon Musk influence

Elon Musk has been one of the early adopters of the crypto fandom. His support for the meme coin Doge came in 2019, which helped other altcoins outperform too. Today, DOGE is the acronym for the proposed Department of Government Efficiency, which Musk is supposed to lead once the Trump administration takes over after the inauguration on January 20.

Bitcoin seems to be coming of age after going through a lot; from frauds, insolvencies and hacks to outright bans by governments and regulators. It got hate from even some of the younger folks for the amount of fuel it takes to mine one bitcoin and the high gas fees charged on the platforms.

The environmental impact forced Musk’s own company Tesla to reject Bitcoin as payment for some time. Today, according to the company website, the trillion-dollar electric vehicle maker accepts only Dogecoin among all cryptocurrencies.

The last 15 years have not been for the weak-hearted. The volatility in its price scared even seasoned investors. Academics and economists questioned its purpose, relevance, and prospects.

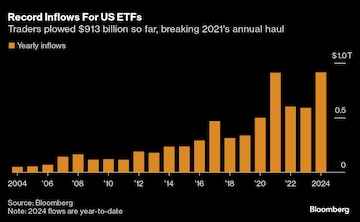

The rise of Bitcoin ETFs

While it has not been steady, the progress is undeniable. In 2017, the Chicago Board of Exchange allowed trading in Bitcoin futures. It took another six years but today the bourse allows Bitcoin ETFs.

Global asset managers such as Blackrock, Fidelity, Invesco, and Templeton operate a Bitcoin ETF that buys Bitcoin from the spot markets. Total assets under management surpassed $75 billion within 10 months of its launch, making it the world’s most successful ETF launch ever.

In Bitcoin’s shadow, decentralised finance (DeFi) has also mushroomed, non-fungible tokens (NFTs) have found hope. The total market capitalisation of all crypto assets has crossed $3 trillion, more than the national income of countries like Canada, Mexico, Brazil, Italy, and Singapore. The crypto market cap is bigger than that of silver today.

Yet, the road is a long, winding one. Fears of crypto use by sinister forces for money laundering and drug trade are still as valid as they were on day one, and proven many times, making regulatory interventions inevitable.

India has been pushing for a global consensus for crypto regulations. The Finance Ministry has already invited stakeholders to contribute. Meanwhile, the world is waiting to see Trump’s moves on this count as President of the US.

Before its fifteenth birthday, Bitcoin has outperformed most asset classes and created some of the fastest billionaires on record. Year 16 promises to be just as exciting.

ALSO READ: One of India’s biggest bankers still dismisses bitcoin