He said the Fed does not need to lower rates, particularly given the risk of higher inflation driven by policies from the incoming Trump administration.

The next Federal Open Market Committee (FOMC) meeting is scheduled for January 28-29.

Apart from the absence of significant rate cuts, Matthews also outlined several other factors that could drive a major correction in the US market this year.

Also Read: Devina Mehra’s thumb rule to spot market froth

He pointed to overly optimistic earnings expectations, with consensus forecasting 13% growth this year—a high bar to meet. Even with such growth, the price-to-earnings ratio of the S&P 500 remains elevated at 22 times earnings, which he described as “on the rich side.”

Investor sentiment is also at near-record levels, with 53% of Americans expecting the S&P 500 to be higher in 12 months, a level of optimism rarely seen since the 1980s, he noted.

Also Read: The two big reasons why the US Fed turned hawkish

For Indian markets, the S&P 500’s performance and the US dollar’s strength will play crucial roles in determining foreign institutional investors’ (FIIs) behaviour.

While the dollar is very strong, it is unlikely to rise much further due to its overvaluation based on economic fundamentals.

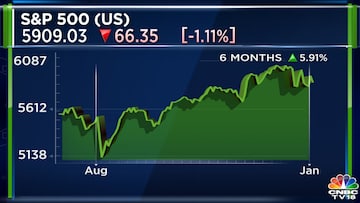

A minor correction of 5-10% in the S&P 500 might not hurt India and could even attract foreign inflows as investors seek alternatives. However, a full-blown bear market in the US, defined as a 20% or greater drop, could trigger widespread risk aversion, impacting Indian equities and other global markets, he said.

Matthews had earlier warned that the US market could correct 20% this year.

Also Read: How China’s currency move may have led to India’s market crash

For the entire interview, watch the accompanying video

First Published: Jan 8, 2025 12:22 PM IST