| Company | Value | Change | %Change |

|---|

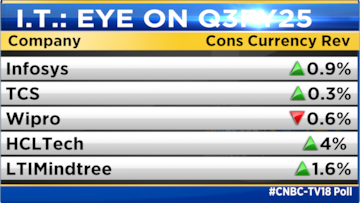

Among the Nifty 50 IT stocks, HCLTech is likely to report the highest growth among its peers with a 4% growth quarter-on-quarter on a constant currency basis. This will be led by the seasonality of its products business. Other than HCLTech, barring LTIMindtree, no other company is expected to report growth of 1% or more.

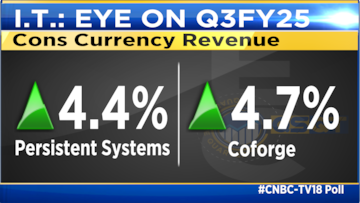

On the flip side, midcap IT outperformers like Persistent Systems and Coforge are likely to continue the outperformance during the quarter with gains between 4% to 5% on a constant currency basis. Both these stocks were also the top gainers on the Nifty IT index in 2024 with gains of 70% and 60% respectively.

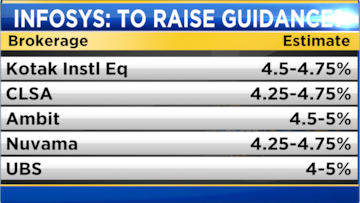

All eyes will now be on whether Infosys will raise its guidance for the full year. Most analysts either expect an increase in guidance or narrowing of the guidance band. There is consensus though on the fact that its EBIT margin guidance of 20% to 22% will remain unchanged.

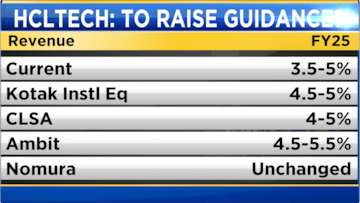

HCLTech too could raise its organic revenue growth guidance from 3.5% to 5% earlier to 4% to 5% or 4.5% to 5%. Here too, the EBIT margin guidance is likely to be retained between 18% to 19%.

For Wipro, the company is likely to see a fourth quarter guidance figure of a negative 0.5% to a positive 1.5% in constant currency terms.

What will be the street watching out for during the quarter?

- Recovery in discretionary spends

- Recovery in stressed sectors like Telecom and manufacturing

- A Pick up in hiring

- Gen AI as a growth driver

- and Client budgets & deal wins which have been muted

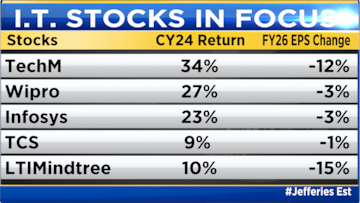

The Nifty IT index has returned over 20% to investors for two consecutive years and 2024 saw a 13% outperformance compared to the Nifty. Stocks had begun to move in the second half of the year as growth showed signs of bottoming out. Managements too turned constructive on the BFSI space and many stocks moved despite a double-digit cut to their Earnings Per Share (EPS) estimates.

Wipro was a case in point. Despite a cut to earnings estimates, the stock gained nearly 30% last year, its Price-to-Earnings multiple got re-rated to 24.7x from 19.7x last year. It is this move that prompted CLSA to recently downgrade the stock and Citi to introduce a 90-day negative catalyst watch on the stock.

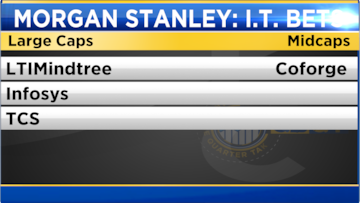

Morgan Stanley says that unlike the start of 2024, when sector positioning was light, investors are now overweight IT. IT outperformance would require positive revenue and earnings revisions – which appear less likely amid the current macro. The brokerage remains selective and advises booking profits if the stocks outperform in the first quarter of calendar year 2025. Their top picks within largecap IT include LTIMindtree, Infosys and TCS within the largecap space and Coforge within midcaps.

On the flip side, Jefferies believes that improving growth outlook will support premium valuations for IT stocks. This improving growth outlook, coupled with the recent earnings cuts in key domestic sectors should support valuations at current levels. It prefers stocks with strong growth visibility like Infosys, TCS, LTIMindtree among the largecaps and Sagility, Coforge, and Mphasis among the midcap IT names.

(Edited by : Hormaz Fatakia)

First Published: Jan 7, 2025 3:29 PM IST