| Company | Value | Change | %Change |

|---|

CASA (current account savings account) deposits recorded a modest 4.39% year-on-year growth, amounting to ₹67,888 crore. However, the CASA ratio declined to 48.17%, compared to 50.59% a year earlier and 48.6% in the previous quarter. Gross investments saw a robust 26.97% year-on-year rise, totalling ₹41,394.3 crore.

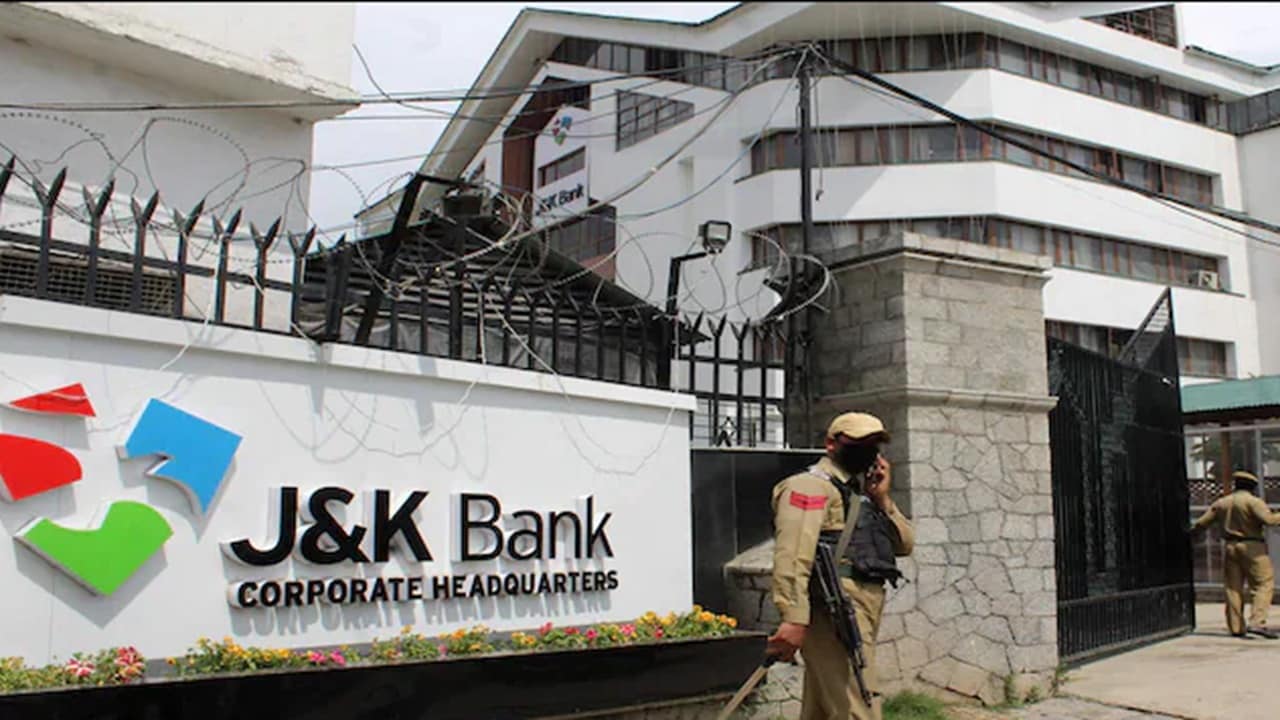

Jammu and Kashmir Bank posted a net profit of ₹550.92 crores, compared with ₹381.07 crores a year ago. It reported a net profit of ₹415.49 crores in the last quarter. The bank’s net interest income during the second quarter was ₹1,435.93 crores, compared with ₹1,333.83 crores a year earlier.

Also Read: New J&K Bank CEO outlines top priorities to drive growth

The net NPA ratio moderated by 19 basis points to 0.85% YoY from 1.04%. In terms of segmental performance, the lender’s retail business contributed the highest to the total income, with ‘other retail banking’ segment income amounting to ₹580.30, up from ₹534.14 posted a year ago.

The corporate/wholesale banking segment was the second-biggest income generator for the lender during the quarter. The segment reported a revenue of ₹445.21 crores in the quarter, compared with ₹337.64 a year earlier.

The percentage of net non-performing assets (NPA) to net advances stood at 0.85%, vs 1.04% a year ago.

Shares of Jammu and Kashmir Bank Ltd ended at ₹97.55, down by ₹3.15, or 3.13% on the BSE.

Also Read: J&K Bank sees deposit growth since July, says no signs of stress on unsecured loans