“We are quite positive about Marico from a near-term and medium-term perspective,” he said.

Titan benefited from the marriage and festival season and the strong gold pricing is helping the company along with other jewellers.

Discussing the demerger of ITC Hotels on January 6, he said the listing price is expected at ₹150-175 per share.

“ITC Hotels, once it starts trading around ₹35,000 crore kind of market capitalisation, we think the industry and the Street could value it at around 25-30 times EV/EBITDA given it is much larger than most other peers,” he said.

EV stands for Enterprise Value while EBITDA is the earnings before interest, tax, depreciation, and amortisation.

The restructuring, announced in July 2023, will result in ITC retaining a 40% stake in its hotel business, while shareholders will directly hold the remaining 60% through a rights entitlement. For every 10 ITC shares owned, shareholders will receive one share of ITC Hotels.

Roy also sees a lot of optimism and positivity for Jubilant Foodworks. He remains positive on the stock from a longer-term perspective.

These are the edited transcript of the interview.

Q: Titan’s October-December 2024 (Q3FY25) update, the overall sales growth 24%, jewellery 26% but the concern in July-September 2024 (Q2FY25) was on margins, and they downgraded their margin guidance, citing competition. How did these numbers stack up versus your expectations for Titan?

A: It is a decent set of numbers by Titan. Clearly, marriage season, the festival season and the strong gold pricing is helping Titan and other jewellers.

The concern of margins continues to remain, but my sense is now base has become a bit more favourable. With 25% kind of growth, they can get some level of operating leverage also kicking in. Here, what we need to see is how the gold versus the studded share is because studded generally, obviously is a higher margin and competitive intensity has been the key concern for Titan. So overall, sales numbers are decent, but largely as per expectation. My sense is other jewellers also should see good numbers because of these reasons, gold pricing and strong marriage and festival demand.

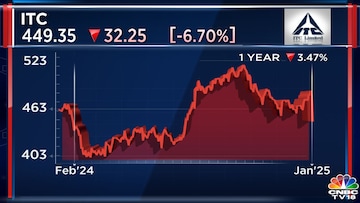

Q: On ITC, we are looking at the demerger of the hotel business, finally getting in motion. What is the kind of valuation you are ascribing to it? And ex of the hotel’s business, what do you see ahead for ITC, the rest of the businesses themselves? Just trying to understand whether, as a shareholder, you will be more optimistic on the ex of the hotels business or hotels or both.

A: So hotels business was a very small part of ITC’s overall Sum of the Parts (SOTP). It is not that we were not doing SOTP, but yes, it is a good, win-win for the shareholders also, and for the company also. So we expect that the hotel, once it gets listed in February first half, will have around ₹35,000 crore market capitalisation for ITC hotel business. And today, of course, ITC stock should account for that. So you will see some technical corrections there. We expect around ₹15 kind of a correction in ITC main company.

But ITC currently will not be in our top picks. We continue to like it for the longer term, but the February 1 Union Budget is a key monitorable. Our personal belief is probability of a sharp tax hike in cigarettes on February 1 is very low, given the illegal industry continues to remain concerned. And even in the October-December 2024 quarter, we expect 3.5% volume growth for cigarettes. So the rational tax industry for cigarettes is the right way for the government and for the customer.

But overall October-December 2024 quarter results for ITC will be a bit muted. We expect almost flattish Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA), because the FMCG business is likely to see profit decline because of the palm oil’s sharp inflation and because of the maida sharp inflation will see weak numbers. So overall, ITC group from long term, but currently, our top picks will be essentially United Spirits, United Breweries, Marico and Pidilite.

Q: The ITC stock price today corrects just by around ₹15-20, is that correct?

A: Yes, that is our expectation.

Q: And what kind of value do you ascribe to the hotel business, if you would give us that shared price number? And also, what multiple are you giving it? Because you have Indian Hotels that gets the premium, and then the other players, they get anything between 15-25 times. So what value are you giving to ITC hotels?

A: In our view, ITC hotels, once it starts trading around ₹35,000 crore kind of market capitalisation, we think the industry and the Street could value at around 25-30 times EV/EBITDA given it is much larger than most other peers – of course, Indian Hotel is bigger – we see that around ₹150-175 would be the price of ITC Hotels once it gets listed.

Q: We just had Jubilant Food as well that came out with a set of numbers, which looks pretty okay. The stock is at a fresh 52-week high. What is your view on the counter?

A: What we are seeing is market share gains for Jubilant Food are happening. If you see even the past few quarters, the numbers are improving. And the gap with Pizza Hut, when you see numbers of the Devyani International with Sapphire Foods India etc, clearly, gap is for Domino’s, is increasing.

Secondly, the stock has also done well, apart from the recovery in the same-store sales growth (SSSG) and delivery format, of course, at the promoter level what is happening at the Coca-Cola franchisee – is also an interesting development. And now my sense is clearly we will see Coca-Cola getting sold inside Domino’s stores also. So we are seeing a lot of optimism, a lot of positivity for Jubilant Food. And this kind of number is a good number.

You have to note that it is now almost eight quarters of slowdown, which the quick-service-restaurant (QSR) industry has seen. So that has brought the base effect clearly. But we are seeing this quarter that Avenue Supermart is also positively surprised, and Domino’s is also positively surprised. So clearly, market share gains are possible for these very well-run companies. So July-September 2024 quarter if you see, Avenue Supermart investors were not happy, but they know how to come back. We have seen 10 stores getting added in Avenue Supermarts, and they have done well, with 17.5% sales growth. So Jubilant Food, we remain positive for the longer term. Of course, valuation comfort is low there, the stock has done well, but it is a good number for Jubilant Foods, SSSG.

Q: Do you think QSR, as a space, is now turning around after eight quarters of subdued growth? We saw Jubilant’s numbers, but what about for the rest of the pack, like a Sapphire Foods, Restaurant Brands, etc?

A: Our sense is eight quarters of a slowdown means that the base has become favorable. So the worst is behind. But this kind of strong numbers for Jubilant Foods – I don’t think the other players are currently seeing. This is more of a delivery format, doing well in which, clearly Domino’s is the number one player. Previous quarter also, if you see within Domino’s, the in store dining was not as strong as the delivery format. So this is more of a market share game. They have done well in terms of pricing, they made free delivery options there. So I would say that this is more of a Domino’s specific. But yes, eight quarters of slowdown does mean that the base has become favorable, and you will see gradual recovery, but not this kind of a number for other QSR in December quarter.

Q: What is your target price for Jubilant Food?

A: The numbers have come, and we will see how the overall EBITDA, etc, pan out. But from a longer term, we are positive. But currently, our top picks in that space will be more like Trent, VMart, etc.

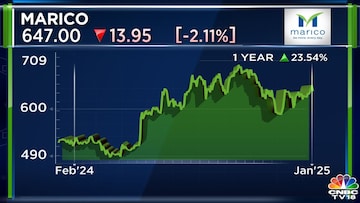

Q: What about Dabur and Marico? What were your key takeaways from the business update?

A: We continue to prefer Marico. In FMCG, the mid and top-end urban is still doing quite well. The problem is the lower end. So Dabur, if you see – mass consumption, clearly the impact is there. Impact of Campa Cola is also there? You will see the same thing pan out for Tata Consumers – weak numbers in NourishCo Beverages Limited, in the October-December 2024 quarter. Although they will see good volume growth in NourishCo, overall they will see sales decline in NourishCo this quarter also. So we are seeing that Campa Cola impact and the lower end of the urban consumption is an issue for Dabur.

Marico – a good set of numbers. So we would be quite positive on Marico from a near-term, medium-term perspective. The stock has done well, but for Marico, 6% volume growth and 15% sales growth is a good number. Now some investors may see that gross margin pressure EBITDA margin pressure, but that is how Marico operates. So when sharp inflation happens, they take pricing, but they also go for market share expansion. So we are positive on Marico.

Our sense is for Nestle, etc., valuation correction has happened, but for urban-focused companies, triggers are still missing, but Marico has done well because they cater more to the mid and top end of the urban consumption, not to the lower end of the consumption in their foods and personal care segment.

For more details, watch the accompanying video

Catch all the latest updates from the stock market here