“The Union Budget, due to be presented next month, must provide income support to India’s poor and tax relief for the middle classes,” Jairam Ramesh, a Member of Parliament from the opposition party (Congress), said in a statement on December 3. India’s Finance Minister Nirmala Sitharaman has an unenviable task. The government’s revenue has slowed considerably in recent months, leaving little room for the tax breaks and incentives everyone — from the common man to corporations — is asking for. REUTERS/ Anindito Mukherjee

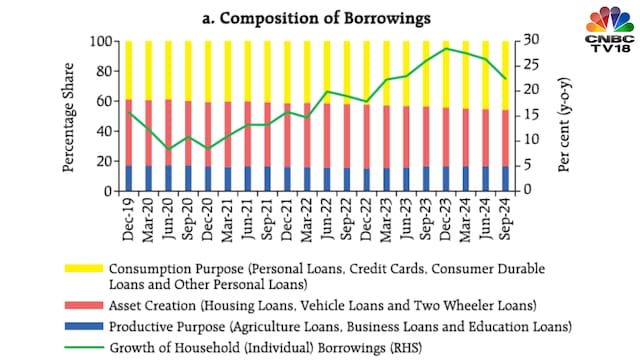

Household debt, meanwhile, is rising. According to data from the Reserve Bank of India (RBI), people are even borrowing to meet daily expenses. As rising inflation forces people to cut corners, it’s not just companies that are fearing a profit squeeze; the government is, too. Chart source: Reserve Bank of India.

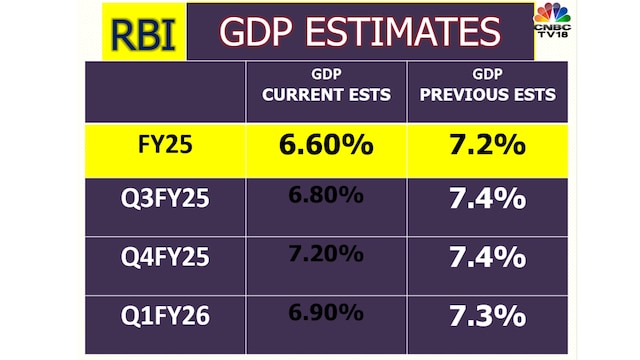

A report by Mumbai-based brokerage firm Motilal Oswal estimates India’s real GDP growth in the October-December quarter of 2024 may improve to 5.5-5.7% year-on-year, compared to 5.4% in the preceding three months. However, even this improved number will be much lower than the RBI’s forecast of 6.8%.

One problem is that while investment growth picked up to a six-month high of 5.2% in November 2024, total consumption growth decelerated to 5.4% in November from 8.3% a month earlier (Motilal Oswal report). It thus becomes imperative for the government to find ways to revive consumer demand because household spending contributed to 60.4% of India’s gross domestic product (GDP) at the end of June 2024.

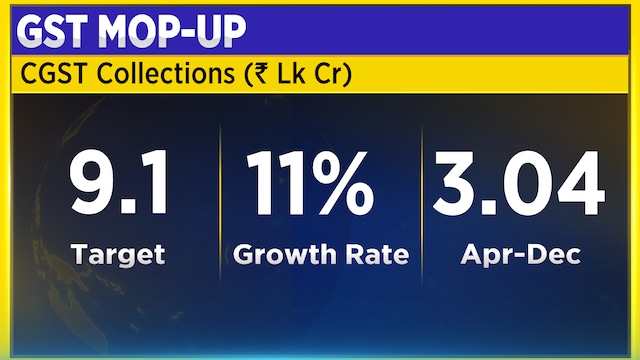

The government had budgeted ₹9.1 lakh crore in central goods and services tax for the financial year ending March 2025. However, the total CGST collection up to December stood at just a little over ₹3 lakh crore. Unless there’s a big spike in the last three months, the exchequer may fall short of the 11% growth target projected in July 2024.

GST is just one part of the pain. Overall tax revenue — which accounted for 63% of all the money that the government had to spend in July 2024— fell five months in a row and shrank 10.7% between April and November 2024 compared to the same period last year. This fall is on an already lower base, as tax revenue fell 14.7% in the first eight months of the last financial year. Meanwhile, total expenditure growth was 3.3%.

The bulk of the fall in tax collection is due to a decline in corporate tax and excise duties, signalling an economic slump. Individual taxpayers have made up for some of the shortfall with 23.5% growth in income tax collection between April and November 2024, over and above the 29.4% growth in the same period last year, according to data from Emkay Global. Between inflation and stagnating earnings, individual taxpayers may not have the capacity to shoulder any more burden.

Growth in new vehicle registrations in December 2024 was the worst in 46 months. “Rural consumption has been slowing for six quarters in a row. The pick-up during the festive season has been modest and on a low base,” Pankaj Murarka of Renaissance Investment Managers told CNBC-TV18.

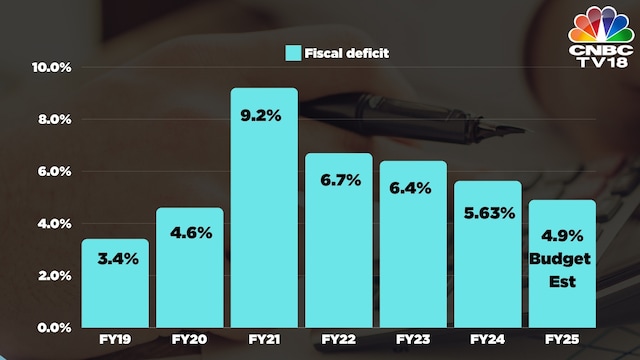

Fiscal deficit, the difference between the government’s earnings and expenses, was at ₹8.4 lakh crore, 52.5% of its target till March 2025. “The finance minister has set a target of a 4.5% deficit for the upcoming year, but achieving a substantial reduction in the debt-to-GDP ratio, as previously planned, requires more severe fiscal adjustments,” renowned economist Montek Singh Ahluwalia, the former head of the erstwhile Planning Commission, said in an interview with ANI, a news agency.

So, the government has to keep its debt under check while spending more on infrastructure projects. Against this backdrop, providing relief to the taxpayer to consume more will be a challenge. Calling it a tightrope walk for Sitharaman is an understatement.