| Company | Value | Change | %Change |

|---|

The scam leveraged non-public information (NPI) related to trades by a major US-based fund house, referred to as the “Big Client,” whose funds are registered as Foreign Portfolio Investors (FPIs) in India.

SEBI order highlights modus operandi

The order details how the scheme was orchestrated:

The order issued by SEBI’s Whole-time Member Kamlesh Varshney stated, “Noticees no. 1 and 2 i.e. Rohit Salgaocar and Ketan Parekh devised the entire scheme to unjustly enrich from the NPI pertaining to the Big Client by orchestrating front running activities. Noticee no. 10 (Ashok Kumar Poddar) has admitted to be a facilitator in the front running activities. Further, Noticees no. 2 and 10 i.e. Ketan Parekh and Ashok Kumar Poddar had been prohibited from dealing in the securities and debarred from associating with the securities market in the past as well. Considering the same, Noticees no. 1,2 and 10 shall be restrained from buying, selling or dealing in securities or associating with any intermediary registered with SEBI, either directly or indirectly, with immediate effect.”

It added, “Traders of the Big Client (a fund house where Salgaokar had close connections) were discussing with Rohit Salgaocar prior to executing trades and such information was prima facie encashed by Rohit Salgaocar by sharing the same with Ketan Parekh. While the traders of the Big Client were discussing trades with Rohit Salgaocar for ensuring counter parties for their trading, Rohit Salgaocar was using that information to make illegal profits by routing information to Ketan Parekh. “

SEBI added that Parekh systematically utilised this information: “After receiving specific and timely instructions, directly or indirectly, from Ketan Parekh, the FRs used to execute orders and made unjust profits. Noticee no. 2 i.e., Ketan Parekh is not an ordinary person. He was debarred from the securities markets for 14 years earlier also.”

SEBI’s observations on information flow

According to the order, Rohit Salgaonkar, owing to his connections, had access to NPI about trades planned by the Big Client. It notes:

“The dealer of the Big Client provides me with the name of the stock they are interested in. I check the availability with different market participants, including foreign funds, Indian funds, other holders of the shares and lastly Ketan Parekh. Around 90% of the Big Client trades were being fulfilled by Ketan Parekh alone,” Salgaonkar admitted.

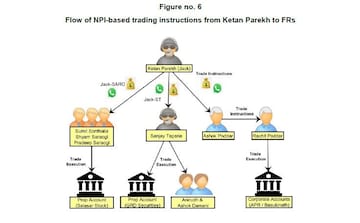

Ketan Parekh, using pseudonyms like “Jack,” “Jack New,” and “Boss,” received this information through WhatsApp and passed on specific trading instructions to execute the trades via his extensive network.

It further highlighted: “Prior to execution of suspicious trades, FRs were receiving trade instructions through WhatsApp chats or calls from a person whose contact number(s) was saved in the devices as Jack/Jack New/Jack Latest New/Boss, etc. Upon analysis of these contact numbers, it was found that these numbers belonged to Ketan Parekh.”

A diagrammatic representation of information flow from Ketan Parekh to FRs (Source: SEBI)

SEBI clarified that while Motilal Oswal and Nuvama Wealth Management facilitated Big Client trades, no evidence of wrongdoing was found against them. The SCN stated: “The trades of the Big Client undertaken through Nuvama and Motilal matched with trades of FRs. However, no evidence implicating these trading members in the alleged fraud has been discovered.”

The order raised critical questions for the accused, including- the source and handling of NPI, the mechanics of trading instructions communicated through WhatsApp, details of profit-sharing arrangements among collaborators.