Index Fund Corner

Sponsored

| Scheme Name | 1-Year Return | Invest Now | Fund Category | Expense Ratio |

|---|---|---|---|---|

| Axis Nifty 50 Index Fund | +32.80% | Invest Now | Equity: Large Cap | 0.12% |

| Axis Nifty 100 Index Fund | +38.59% | Invest Now | Equity: Large Cap | 0.21% |

| Axis Nifty Next 50 Index Fund | +71.83% | Invest Now | Equity: Large Cap | 0.25% |

| Axis Nifty 500 Index Fund | — | Invest Now | Equity: Flexi Cap | 0.10% |

| Axis Nifty Midcap 50 Index Fund | +46.03% | Invest Now | Equity: Mid Cap | 0.28% |

Missing the employer’s deadline can result in higher taxes being deducted from salaries in January, February, and March.

What investments qualify?

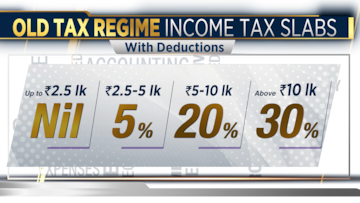

For those following the old tax regime, several investments and expenses qualify for tax deductions under Section 80C of the Income Tax Act, up to a limit of ₹1.5 lakh.

Common options include:

Employees’ Provident Fund (EPF): Contributions made to EPF automatically count towards your deduction limit.

Life insurance premiums: Premiums paid for policies covering yourself, your spouse, or your children are eligible.

Children’s school fees: Tuition fees paid for up to two children can be claimed.

Home loan repayments: Principal repayments on a home loan are deductible under 80C.

Tax-saving instruments: Investments in Public Provident Fund (PPF), National Savings Certificate (NSC), Equity Linked Savings Schemes (ELSS), and tax-saving fixed deposits also qualify.

Additionally, deductions under other sections, such as 80D (health insurance premiums) and 80E (education loan interest), may require proof submission.

Tips for timely submission

Tax planning should begin in April. Identify eligible investments and expenses throughout the year to avoid last-minute stress.

Keep receipts, account statements, and policy documents ready for submission. Employers usually provide a checklist of required proofs.

Many employers have online systems for submitting investment proofs. Use these platforms to upload scanned copies of your documents.

Ensure that your combined investments and expenses do not exceed the ₹1.5 lakh limit under Section 80C. Excess amounts will not provide additional tax benefits.

If unsure, consult a financial advisor or tax expert to ensure you maximise eligible deductions and avoid errors.

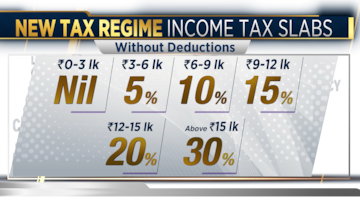

For employees under the new tax regime

The new tax regime does not allow deductions under Section 80C or similar sections. Employees opting for this regime should declare their preference early to avoid discrepancies in TDS calculations.

What happens after submission?

Employers verify submitted proofs and adjust TDS deductions for the remaining months of the financial year.

If you miss the deadline, higher taxes may be deducted, but you can still claim eligible deductions when filing your income tax return (ITR).