| Company | Value | Change | %Change |

|---|

CS Setty, Chairman of SBI, attributed the gains to the bank’s resilience, consistent delivery, and proactive digital investments.

“The markets took some time to recognise the potential of this stock,” Setty said in an interview with CNBC-TV18.

Also Read: A $2 billion fund manager increases weightage on largecaps

He highlighted that SBI’s record-breaking profit, the highest among Indian corporates, played a pivotal role in boosting market confidence.

SBI also focused on strengthening its traditional business lines, including MSMEs, large-value agriculture, and home loans, where it continues to lead the market.

Investments in technology and digital adoption helped the bank enhance customer offerings and improve operational efficiency.

He also highlighted the bank’s strong asset quality as a critical factor in boosting market confidence. These efforts collectively contributed to a positive market outlook for State Bank.

Setty highlighted that corporate credit growth is being driven by sectors such as renewables, roads, and petrochemical expansion. However, core sectors like steel and cement are seeing more consolidation rather than significant capital expansion.

This is the verbatim transcript of the interview.

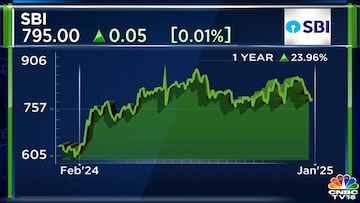

Q: 2024 was not an unkind year at all for State Bank of India. It was bad for the banking sector. I am entirely talking from a market point of view, the Bank Nifty, went up only 4%, whereas the Nifty went up 9% but State Bank shares went up 24%. What went so right for SBI in 2024?

A: The markets took some time to recognise the potential of this stock. What we have shown our resilience and consistency in our performance, essentially, it is not only in terms of the largest amount of profit among the corporates in India. We also had focused on increasing our customer offerings, number one. Number two, we continued to invest in the technology and digital adoptions that also had contributed to our recognising the value what SBI brings to the fore.

The other thing is some of the conventional business lines, what SBI has been known for, we have strengthened our focus on them, particularly on the MSME, large value agriculture, and we continue to be market leader in home loans. More importantly, above all we have demonstrated the resilience in our asset quality. All these things have helped us to present a good picture to the market.

Q: The big problem that bedevilled the banking sector, and one of the reasons why perhaps the index itself underperformed, is this desperate hunt for deposits and the rise in the costs. How do you see that panning out? Will the cost of deposits abate?

A: As I mentioned earlier, there is only so much we can compete on the interest rates, and we have to increase our customer services and in terms of value proposition, which the bank account brings or bank deposit bring to the customers. More importantly, the post COVID credit growth, which was substantially high, and the deposits have not kept pace, probably had created this imbalance.

If you see the November numbers, I think broadly, both the deposits and advances are coming to some equilibrium. The renewed focus on the deposit mobilisation by the banks and the balanced growth in advances, is helping us to set the balance in place. I don’t think there will be too much cost escalation on the deposits, all the banks are focusing on activating their networks, banks networks, and also redesigning the products and processes, on how do we retain and mobilise more deposits.

Read Here | How good will 2025 be for SBI shareholders?

Q: Even SBI offered one 8% product for the one year FD is that the peak?

A: I don’t think we have offered 8%, but it is our highest rate, Amrit Vrishti is around 7.25%, so with some additional interest rate for the senior citizens. I personally believe that interest rates on the deposits are peaked.

Q: How do you see credit growth picking up? Credit growth had to be brought down below deposit growth, or at least to deposit growth. Where are you seeing a credit demand? Are you seeing industries, corporates hungry for credit at all?

A: Corporate credit growth, essentially is coming from some of the sectors — renewables, roads, some of the petrochemical expansion has also contributed to the credit growth. But the core sectors, the capital expansion has not been happening, particularly in the steel, cement there is a more of consolidation which has been happening there.

One important thing, what we know noticed is the housing sector is doing well, which means that some of these sectors, like steel, cement, probably would do better in the current calendar year. As far as renewables is concerned, the renewables is coming across, solar, hydro, pumped hydro, for instance. A lot of capacity additions is happening on the renewables, and the green financing probably would be more focused in the current calendar year.

For full interview, watch accompanying video

Also Read | Mega CNBC-TV18 Poll For 2025: This is the biggest investment theme for the new year