| Company | Value | Change | %Change |

|---|

Maruti Suzuki’s total sales rose 29.6% year-on-year (YoY) to 1.78 lakh units, compared to 1.37 lakh units in the same period a year ago. According to a CNBC-TV18 poll, the company was expected to report sales of 1.63 lakh units.

Total domestic sales rose 27.3% to 1.41 lakh units, compared to 1.10 lakh units YoY.

Total domestic passenger vehicle (PV) sales rose 24.2% to 1.30 lakh units from 1.05 lakh units YoY. Total Exports rose 39.2% to 37,419 units from 26,884 units YoY.

Maruti Suzuki India Ltd. had announced on December 6 that it has plans to increase the prices of its cars starting January 2025.

In an exchange filing, Maruti had said that the price hike will be up to 4% and will vary depending on the model.

Maruti Suzuki attributed the intention to increase prices to rising input costs and operational expenses.

“While the company continuously strives to optimise costs and minimise the impact on its customers, some portion of the increased cost may need to be passed on to the market,” Maruti Suzuki said in its statement.

For the September quarter, Maruti Suzuki’s Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) fell to a three-quarter low, while margin narrowed by 100 basis points to 11.9%.

The EBITDA margin for the quarter was 20 basis points lower than the CNBC-TV18 estimate of 11.7%.

Flat realisations, higher promotion expenses dragged margins to the lowest in five quarters.

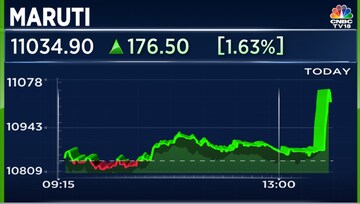

Shares of Maruti Suzuki India are off the lows of the day post the announcement, currently trading 2.78% higher at ₹11,160.05. The stock has declined 18% from its peak of ₹13,680.

Maruti Suzuki shares have risen nearly 9% in the last one year.