Describing India’s tariff regime as the “most complex globally,” ICEA highlighted that multiple duty rates—ranging from 0%, 2.5%, 5%, 7.5%, 10%, 15%, plus surcharge—are creating significant challenges for manufacturers. The association has proposed a simplified structure with four slabs: 0%, 5%, 10%, and 15%.

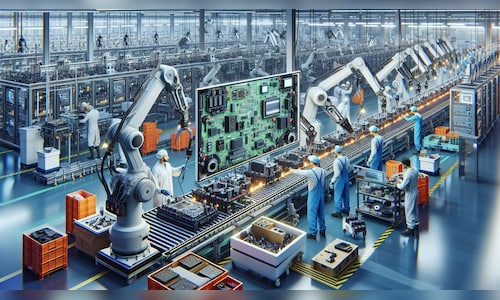

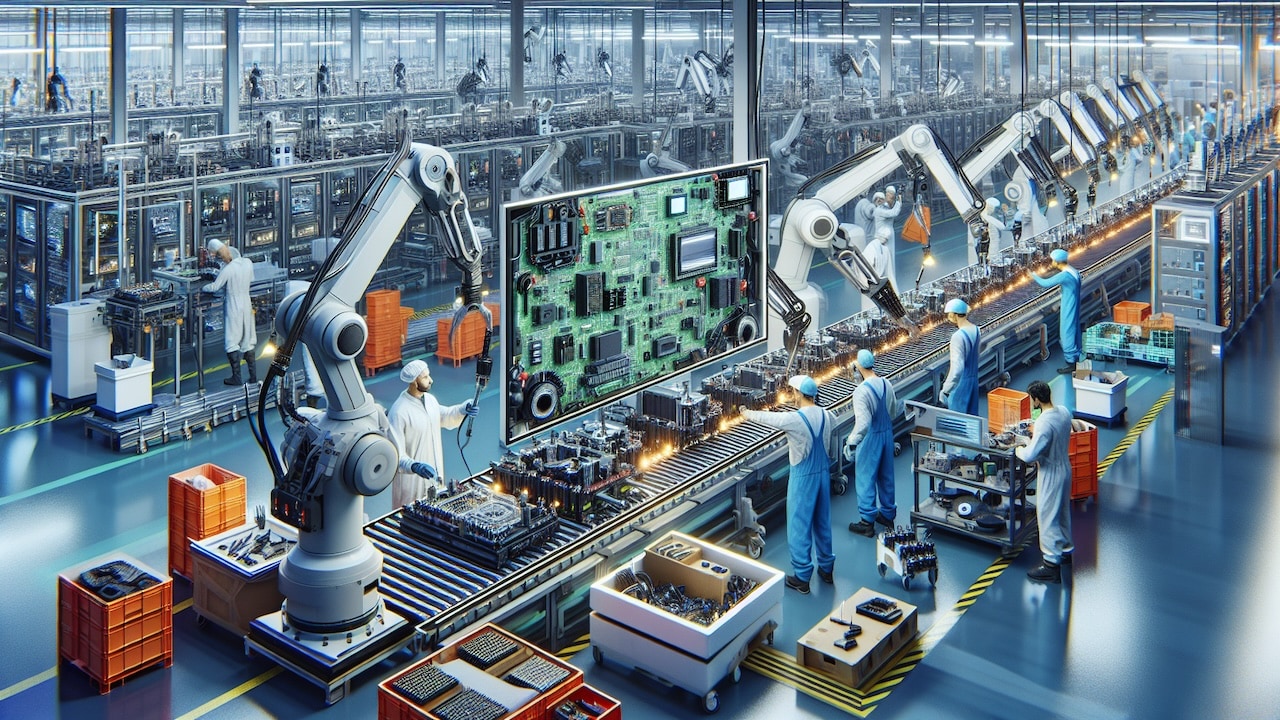

Mobile Manufacturing

High tariffs on sub-assemblies and key components are driving up manufacturing costs. ICEA has recommended reducing the 2.5% duty on critical parts such as PCBA (Printed Circuit Board Assembly), camera modules, and connectors to alleviate cost pressures.

Television Manufacturing

The current 2.5% duty on TV inputs is impacting cost efficiency in TV manufacturing. ICEA has urged the government to eliminate duties on sub-assembly inputs for open cells, a critical component in television production.

Hearables Sector

Acknowledging that the hearables industry is still in its early stages, ICEA highlighted the need to maintain the existing duty structure and extend the ongoing duty cuts set to expire in FY26.

Automotive Displays

ICEA pointed out that the 15% duty on car display parts is undermining cost-effectiveness in the sector. To encourage scalability and competitiveness, the association recommended a 0% duty on all inputs for display assemblies.

The recommendations aim to streamline costs, attract investments, and position India as a global hub for electronics manufacturing ahead of the crucial Union Budget.