| Company | Value | Change | %Change |

|---|

|

Return, %

|

NIFTY

|

NIFTY Bank

|

|

CY2019

|

12.0

|

18.4

|

|

CY2020

|

14.9

|

–2.8

|

|

CY2021

|

24.1

|

13.5

|

|

CY2022

|

4.3

|

21.2

|

|

CY2023

|

20.0

|

12.3

|

|

CY2024

|

8.8

|

5.5

|

Over the past six years, several prominent banks have faced significant challenges, delivering negative returns on a cumulative and year-on-year basis. RBL Bank, Bandhan Bank, DCB Bank, IndusInd Bank, YES Bank, and Bank of India have all seen their stock prices decline over this period, reflecting broader sectoral struggles and specific institutional challenges.

|

Banks

|

1 year, %

|

6 years, %

|

|

YES Bank

|

–9.3

|

–89.3

|

|

RBL Bank

|

–44.0

|

–72.8

|

|

Bandhan Bank

|

–34.7

|

–71.3

|

|

IndusInd Bank

|

–40.4

|

–40.4

|

|

DCB Bank

|

–9.1

|

–28.6

|

|

BOI

|

–10.9

|

–3.6

|

Year-on-year (YoY), the banking sector has witnessed significant declines, with RBL Bank experiencing the steepest fall in stock value, followed by IndusInd Bank, Bandhan Bank, and IDFC First Bank. All of these banks have posted negative returns in the range of approximately 30% to 44%.

|

Banks

|

1 year, %

|

|

RBL Bank

|

–44.0

|

|

Indusind Bank

|

–40.4

|

|

Bandhan Bank

|

–34.7

|

|

IDFC First Bank

|

–29.5

|

|

CSB Bank

|

–23.6

|

|

J&K Bank

|

–19.0

|

|

BOI

|

–10.9

|

|

YES Bank

|

–9.3

|

|

DCB Bank

|

–9.1

|

|

Kotak Mah Bank

|

–7.8

|

|

Axis Bank

|

–2.3

|

On a YoY basis, the best-performing banks have been Karur Vysya Bank, ICICI Bank, Federal Bank, Indian Bank, and State Bank of India (SBI), all of which have delivered returns of 23% or more.

|

Banks

|

YOY, %

|

|

Karur Vysya Bank

|

29.2

|

|

ICICI Bank

|

28.9

|

|

Federal Bank

|

25.9

|

|

Indian Bank

|

25.4

|

|

SBI

|

23.4

|

|

BOMH

|

14.6

|

|

Canara Bank

|

13.5

|

|

IDBI Bank

|

12.5

|

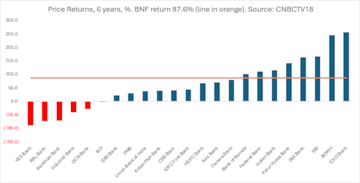

Over the last six years, NIFTY has posted a strong gain of 117.7%, rising from 10,862.55 to 23,644.9 points. In comparison, Bank NIFTY has underperformed, rising 87.6% from 27,160.2 to 50,952.75 points.

While both indices have shown substantial growth, NIFTY’s broader market performance has far outpaced the banking sector’s gains.

|

Banks, %

|

Price Returns, CAGR, 6 years

|

Bank Nifty

|

|

YES Bank

|

–89.3

|

87.6

|

|

RBL Bank

|

–72.8

|

87.6

|

|

Bandhan Bank

|

–71.3

|

87.6

|

|

IndusInd Bank

|

–40.4

|

87.6

|

|

DCB Bank

|

–28.6

|

87.6

|

|

BOI

|

–0.6

|

87.6

|

|

IDBI Bank

|

23.8

|

87.6

|

|

PNB

|

30.1

|

87.6

|

|

Union Bank of India

|

38.7

|

87.6

|

|

Kotak Mah Bank

|

40.0

|

87.6

|

|

CSB Bank

|

42.4

|

87.6

|

|

IDFC First Bank

|

44.6

|

87.6

|

|

HDFC Bank

|

67.4

|

87.6

|

|

Axis Bank

|

71.5

|

87.6

|

|

Canara Bank

|

80.6

|

87.6

|

|

Bank of Baroda

|

101.5

|

87.6

|

|

Federal Bank

|

110.9

|

87.6

|

|

Indian Bank

|

116.6

|

87.6

|

|

Karur Vysya Bank

|

142.5

|

87.6

|

|

J&K Bank

|

164.2

|

87.6

|

|

SBI

|

167.8

|

87.6

|

|

Bank of Maharashtra

|

247.1

|

87.6

|

|

ICICI Bank

|

256.5

|

87.6

|

(Edited by : Ajay Vaishnav)

First Published: Dec 31, 2024 5:15 PM IST