| Company | Value | Change | %Change |

|---|

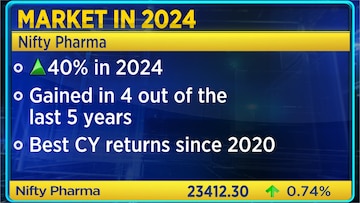

An 8.75% advance was the final tally for the Nifty in 2024, marking its ninth straight positive return in a calendar year. While most sectoral indices ended with gains and the broader markets also outperformed the Nifty, it was the Nifty Pharma index that emerged as the top sectoral gainer with a 40% advance.

The Nifty may have recovered from the lows of the day but it is yet to reach its congestion zone of 23,800 – 24,000 levels. That has become the first level to cross in case of any potential recovery. On the downside though, the Nifty recovering from sub-23,500 levels is indicative that 23,500 remains a crucial downside support for the index.

But the big question, what is in store for 2025?

Will the rally sustain? Will mid and smallcaps continue to outperform?

Now Crystal Gazing is always a challenge. But CNBC-TV18 has reached out to the biggest market experts and bring to you OUTLOOK 2025 – the biggest market poll for the new year! That will be released on Wednesday at 9:20 AM. So watch this space for more!

The bigger challenge for the Nifty though as the month of January begins is the seasonality factor. The month of January for the last six years has resulted in negative returns for the Nifty, with losses ranging between 0.3% to 2.5%.

The month of January will also begin with the auto sales figures for the month of December, macro data in the form of PMI and of course, quarterly business updates from banks and other companies as the December quarter came to an end. Of course, the Fed is also slated to meet towards the later half of the month and that will be the first big trigger for the markets ahead of the Union Budget on February 1.

Foreign institutions remained net sellers in the cash market on Tuesday despite the recovery. Domestic institutions were net buyers.

“So the very short term, the markets are either breaking the November low of 23,264 either straight away, or it’s going to 24,100 which was the figure I had given last week, the market went to 23,900. So the markets are still in line with breaking the November low. Reliance Industries’ under performance continues to be reason for caution,” Jai Bala of cashthechaos.om told CNBC-TV18.

Shrikant Chouhan of Kotak Securities said that the current market texture is weak but a fresh leg of selling will begin only once the Nifty breaks below the 23,550 mark. A slip below that can take the index down to 23,400 levels. A pullback can take the Nifty to 23,800 – 23,875 levels on the higher side.

Compared to the Nifty, the Nifty Bank traded in a narrow range on Tuesday and did not move much on either side of the flat line. While the index has held on to the 50,500 – 50,600 band on the downside, it has struggled to cross the 51,000 mark on the higher end. 2024 was also the second straight year when the banking index underperformed the Nifty. The index ended with gains of 5.4% for the year.

The Nifty Bank has reversed from its trendline support and defended its 200-Day Simple Moving Average. On the upside, the 50-DEMA is a barrier for the index, which is placed at levels of 51,915, said Hrishikesh Yedve of Asit C Mehta Investment Interrmediates. He expects the Nifty Bank to continue trading within this 50,500 – 52,000 band awaiting a breakout on either side.

Om Mehra of SAMCO Securities said that the broader trend for the Nifty Bank remains weak near its 200-Day Moving Average. An inverted hammer projects continuation of the bearish trend. A break below 50,600 can take the Nifty Bank down further to 50,200 levels or even the latest swing low 49,787. He wants the Nifty Bank to close above the 51,430 mark to regain positive traction.

What Are The F&O Cues Indicating?

Fresh long positions were seen in these stocks on Tuesday, meaning an increase in both price and Open Interest:

| Stock | Price Change | OI Change |

| APL Apollo Tubes | 3.42% | 26.42% |

| Adani Total Gas | 3.49% | 16.27% |

| IRB Infra | 3.52% | 15.24% |

| CESC | 0.79% | 10.96% |

| Kalyan Jewellers | 2.17% | 10.00% |

Fresh short positions were seen in these stocks on Tuesday, meaning a decline in price but an increase in Open Interest:

| Stock | Price Change | OI Change |

| IRFC | -0.44% | 19.55% |

| Cyient | -0.16% | 17.63% |

| Indian Bank | -0.38% | 16.70% |

| Oracle Financial | -0.27% | 8.97% |

| MCX | -1.57% | 6.80% |