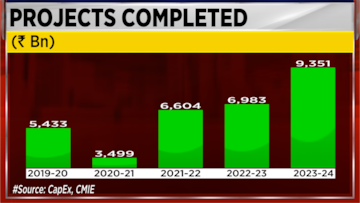

“What we are finding in 2024-25 for the first three quarters is that there is a significant slowdown in the announcement and in completion of projects. While there was a big pickup in 2022-23 and 2023-24 in new investments and completion, and we expected some slowdown, but the slowdown is lower than even the past average. It’s a bit disconcerting that both new investment proposals and completions have slowed down in 2024-25,” he noted.

Vyas explained that CMIE tracks capex through two primary databases:

Capex Database: This tracks the announcement of new large-capacity projects and their progress until completion.

Progress Database: This provides a time series view of how enterprises are proposing and completing projects over different quarters.

“Steadily, people keep announcing new investment projects, and we track them over their life cycle till they are completed. As you take snapshots every quarter, we get a time series of the rate at which enterprises are proposing new projects and completing them,” Vyas said.

Over the past 4-5 years, the government has significantly increased its capex spending. India’s investment-to-GDP ratio has risen from 28% in 2020-21 (FY21) to 34% in 2023-24 (FY24). Much of this growth is driven by government spending, which surged from ₹2.9 lakh crore in 2017 to ₹9.5 lakh crore in 2023-24 (FY24) and is budgeted at ₹11.1 lakh crore for 2024-25 (FY25).

Also Read |

Rewind 2024: Building momentum for India’s capex growth in the coming year

Private sector borrowing has also increased, with loans from banks and markets rising from ₹1.96 lakh crore in 2021-22 (FY22) to ₹5.65 lakh crore in 2023-24 (FY24), according to an RBI report.

Despite these investments, Vyas noted a concerning trend, “While there was a big pickup in 2022-23 (FY23) and 2023-24 (FY24), at least in new investments and in completion, we expected some slowdown from there, but the slowdown is lower than even the past average. So, it’s a bit disconcerting that both new investment proposals and completions have slowed down in 2024-25 (FY25).”

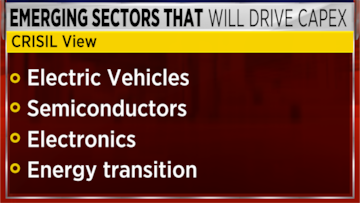

Dharmakirti Joshi, Chief Economist at CRISIL, highlighted challenges with private sector capex. He pointed out that while preconditions for investment are favourable, including lower tax rates, the Production-Linked Incentive (PLI) scheme, and low leverage in the private sector, this potential has not translated into on-ground activity.

“There is a lot of capability to invest, but it is not reflected on the ground,” Joshi said.

Also Read | FinMin sees FY25 growth at 6.5%, cites capex, policy, hiring woes for H1 slowdown

For more details, watch the accompanying video