Since the global financial crisis (GFC) of 2007-2009, banks have become more cautious, reducing risks on their balance sheets, and are now well capitalised. “I am not saying every bank, but in emerging markets, the real rate of interest is quite high, and I find blue-chip banks, leading banks in the countries, have sold off or underperformed as people overinvest in technology,” she explained.

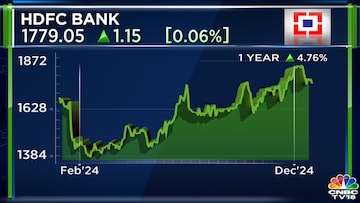

In India, HDFC Bank, a prominent blue-chip bank, has underperformed recently. She attributed this to the bank’s focus on prudent risk management rather than pursuing short-term gains. Unlike many others, HDFC Bank has reduced its exposure to high-margin but risky unsecured consumer loans.

Bhansali is a believer in HDFC Bank’s strategy, describing it as “smart money.”

She appreciated their decision to avoid unnecessary risks now, which allows them to take calculated risks later when returns are more favourable.

Also Read:

HDFC Bank shares are back in Chris Wood’s Asia ex-Japan portfolio at the expense of these stocks

Another sector that could be a beneficiary in the coming year is the tyre industry. The shift toward electric vehicles (EVs) and larger vehicles, such as sports utility vehicles (SUVs), will boost tyre demand. The need for heavy-duty truck tyres in the mining sector also creates strong opportunities for growth.

Bhansali is not optimistic about the US market in the coming year and believes the underlying stresses in the market have been overshadowed by the current excitement surrounding artificial intelligence (AI) and technological advancements.

“We are ignoring a lot of the challenging news that is coming out of markets,” she warned.

Also Read: Trump win could pressure emerging markets, but India may feel the least impact, say experts

For more details, watch the accompanying video