| Company | Value | Change | %Change |

|---|

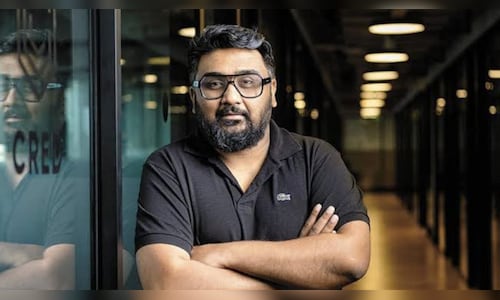

“We are trying to create some new verticals of insurance in the company, but I think even five years later, I would say 80, 85% of our business will still come from distribution of financial services products for the regular entities that exist in the country, be it banks, insurance companies, NBFCs,” Shah said.

Shah explained that the dominance of financial services in CRED’s revenue is explained by the sector’s large revenue and profit-making potential, apart from the easy way to get a good set of customers.

“Today, when an insurance company comes to us, they’re able to actually attract highest quality customers, which will cause lower impact on premium, lower impact on claims and so on and so forth. So I think if you’re able to deliver this consistently over long periods of time, I don’t see any reason to kind of defocus on that,” the CRED Founder said.

Kunal Shah further said that the company is dabbling into new verticals to create new sources of revenue, including secured credit.

“Secured credit is something that Indian consumers prefer many times. It gives you low interest rates, stability, long tenures, and we believe that we have the right audience,” Shah told CNBC-TV18.

First Published: Dec 30, 2024 9:02 PM IST