“The price growth will continue, maybe the pace of growth will begin slightly moderating, but I don’t think that’s a cause for immediate concern,” he said, adding that for luxury property buyers in particular, factors like location, facilities, etc. matter more than price.

The Gurugram-based real estate player is on track to achieve or even exceed its pre-sales guidance of ₹16,000-17,000 crore for 2024-25 (FY25), having achieved ₹7,000 crore in the first half.

Also Read: Nilesh Shah of Kotak has this advice for investors for 2025

Tyagi expects pre-sales guidance for the next fiscal year to surpass this year’s estimates but stated the company would announce specific figures after the fiscal year ends.

“Our target is to eventually hit a gross margin in the range of 45 to 50%. We are currently hovering at the 37 to 40% mark. As more luxury product offerings come to the market, we should start hitting our target margins,” he said.

The margins on new sales continue to be in the 40%-plus range.

DLF has taken measures to maintain the quality of its buyers by increasing the minimum booking price across projects.

Also Read: ‘Why The Heck Not?’: DLF’s KP Singh shares life lessons

The company now requires an upfront deposit of ₹50 lakh for most projects versus ₹10 or 15 lakh earlier, with the ultra-luxury “The Grove” demanding ₹2.5 crore.

“This ensures only serious buyers come in, and the froth gets filtered out,” Tyagi explained. He also highlighted that 25%-27% of its buyers are from the non-resident Indian (NRI) segment.

In the past two and a half years, the company has seen minimal requests for re-trades or buybacks, indicating that buyers are holding onto their purchases.

Tyagi highlighted that the current market is far from the speculative frenzy of the early 2010s, when properties were often bought and sold within six months.

Read Here | Gurugram realty market isn’t ‘frothy’: DLF’s Ashok Tyagi

DLF’s focus in Gurugram is on properties priced above ₹7 crore, with projects like Privana priced at ₹7 crore and Dahlias positioned in the super-luxury segment.

In Chandigarh’s Tricity area, the company’s offerings range between ₹2.5 crore and ₹4 crore. When entering the Mumbai market, DLF plans to position its offerings as premium housing rather than true luxury, with price points in the ₹5-8 crore range.

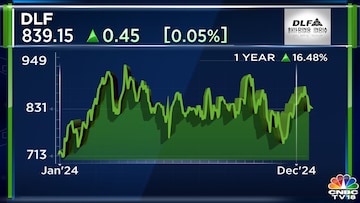

The company, which has a market capitalisation of ₹2,08,136. crore, has seen its shares rise 16% over the last year.

Also Read | DLF Camellias to Oberoi 360: India’s luxury real estate sees blockbuster deals in 2024