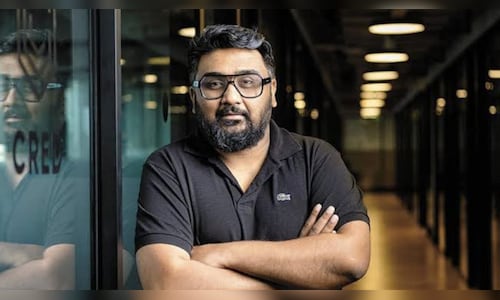

As the year draws to a close, CNBC-TV18 caught up with Kunal Shah, the Founder of Cred, to reflect on the key milestones of 2024 and discuss what 2025 might hold.

Below are the excerpts of the interview.

Q: Start by telling us about what you see were the big milestones for you in 2024, the big lessons and what you look forward to in the coming year.

Shah: 2024 has been a great year. Thankfully, all the initiatives that we have kind of done, are playing out now. We are seeing a lot of good outcomes on all the choices that we made.

Our idea was very simple – to constantly reward good, prudent financial behaviour and make it easy for the consumers to do some of these things, and therefore make it easy for brands, BFSI companies, to access these consumers by the self-selection of them being more financially prudent. All the product directions have been consistent in that direction.

You talked about CRED Money, we realised that especially the affluent customer, had a problem of multiple bank accounts, not really knowing what’s going on, missing a payment here, getting a due date missed out over here, and having a home loan, transferring money here and there. We just realised that if you kind of build more and more for making sure that they don’t have to work hard to do good financial behaviour and get rewarded for it – I think more than rewarded, it’s about recognition that you are on the right track.

We should not forget that majority of India are getting wealth for the first time in their family, credit cards for the first time in their family, mortgage for the first time in their family, investing in any capacity for the first time in their family. And I think unless we constantly guard them and protect them for that, their early experiences will define how the relationship with money will evolve. For a country to get to a developed nation, or as we call it, Viksit Bharat, we will need relationship of money to fundamentally change, and we are trying to be the catalyst to make sure that people have healthy relationship with that and evolve and do mature things.

Coming to our year, more focused approach around growing our audience segment. We saw a large user growth, so the audience segment is growing quite well. We were able to kind of focus more and more on creating more products that help them with good financial behaviour.

Wealth is just a new direction that we have just embarked on. Again, we have made a choice that we will never build a product that is something that we will never offer to our friends and family. So, we will stay away from products that make a lot of money but are not good for the consumers.

Q: What are these products that make a lot of money, but are not good for consumers?

Shah: Anything that is generally more speculative in nature.

Q: So, you won’t get into broking or the trading business?

Shah: I think those are very different things. Allowing investing in long term behaviours is what we want to create, versus kind of things that kind of create more short term benefits for the consumers. The principle is very simple, good financial behaviour comes from consistency and not being fickle with money. We want to encourage that, and our wealth choices are going to be more centred around building something that is generally boring versus exciting when it comes to wealth, because wealth works when you can get consistent, good quality returns over very long periods of time, versus have this extraordinarily spiky, exciting journey which usually ends up becoming wealth erosion.

Watch accompanying video for entire conversation.