| Company | Value | Change | %Change |

|---|

Of these, a ₹300 crore order is from the Varanasi Development Authority for the development of Jawaharlal Nehru Commercial Complex (JLNCC) Englishya Lines in Varanasi on a self-sustainable model.

The next order, worth ₹44 crore, from the Power Grid Corporation of India is for the construction and furnishing of a 500-bed multi-storey ‘Vishram Sadan’ at AIIMS Gorakhpur in Uttar Pradesh.

The last order, worth ₹24.38 crore is from IIT Roorkee, Uttarakhand for the construction of Mehta Family School of Data Science and Artificial Intelligence. This will include EI, HVAC, firefighting, fire alarms, lifts, audio visual system, CCTV and BMS installation and development works at IIT Roorkee.

Last week, NBCC said it bagged multiple orders worth nearly ₹300 crore. Among these, it received an order worth ₹200.6 crore from Oil India Ltd to construct a new OIL hospital in Dulliajan on a turnkey basis under the depository works mode.

Additionally, NBCC’s wholly-owned subsidiary, HSCC (India) Ltd., has secured an order worth ₹98.17 crore to set up an e-library as a unified platform for students and faculty of 22 government medical colleges and three dental colleges under the Medical Education Department, Maharashtra.

NBCC reported its September quarter results, which were higher on some parameters on a year-on-year basis, but its margins saw a contraction compared to last year.

The company’s net profit for the quarter rose by 52.8% from the same quarter last year to ₹125.1 crore from ₹81.9 crore. Revenue for the period stood at ₹2,458.7 crore.

NBCC’s Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) for the quarter stood at ₹100 crore, which was 4.6% higher than the same quarter last year.

EBITDA margin, however, narrowed on a year-on-year basis by 50 basis points to 4.1% from 4.6% during the same period last year.

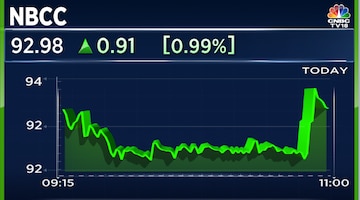

NBCC shares were trading 0.77% up at ₹92.78 apiece at 11.11 am on Friday, December 27. The stock has gained 70.02% this year, so far.

Also Read: Shares of worst Nifty performer of 2024 gain on plans to sell 70% of MFI bad loans

First Published: Dec 27, 2024 11:26 AM IST