Quite a year it has been for the Nifty 50 index in 2024. The index has gained 9% so far this year. But there are some stocks that have made records, but not necessarily in a good connotation. Here is a look at some of these names:

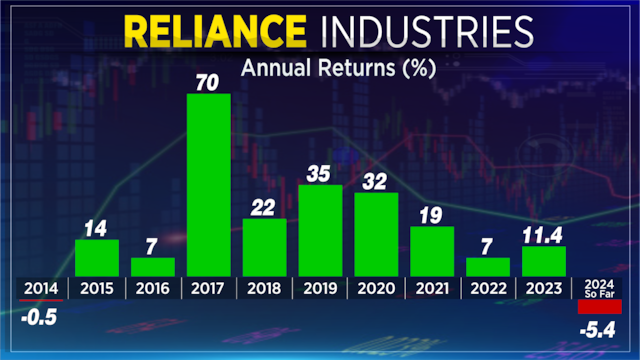

Starting with the index heavyweight reliance industries. With a 5.5% drop so far this year, this may end up being the first year that reliance will deliver negative returns after 2014. Yet, the street remains bullish. Most analysts have a buy rating and targets range from ₹1,350 to as high as ₹1,950 on the stock.

On to India’s largest paint company, Asian Paints. It wasn’t a bad year until the last quarter results and the drop since then, has taken it to the worst calendar year on record for the company. In fact, since 2010, the stock has delivered negative annual returns only thrice, two of those years being 2022 and this one. Most analysts now have a sell call on the stock with targets ranging from ₹2,080 to as high as ₹3,750.

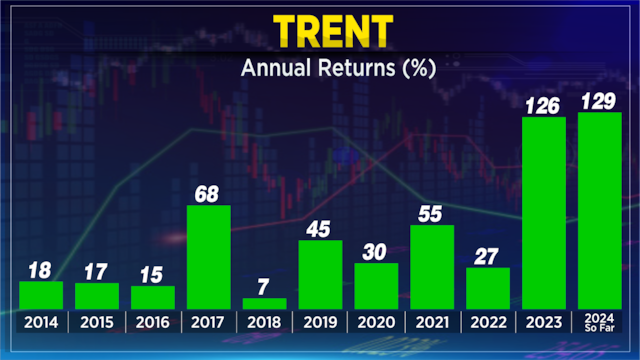

On the flip side, Trent has been a giant wealth creator and is also the top performer on the nifty this year. The stock doubled last year, doubled this year too and has had positive returns every year starting 2014. The street continues to remain bullish with targets hitting as high as ₹9,350.

Mahindra & Mahindra is a turnaround story and the stock has had its best year in terms of returns since 2009. The stock is up 70% this year so far and had gained close to 300% 15 years ago with only three negative annual returns in the interim. The street remains constructive. Price targets range between ₹2,700 to ₹3,700.

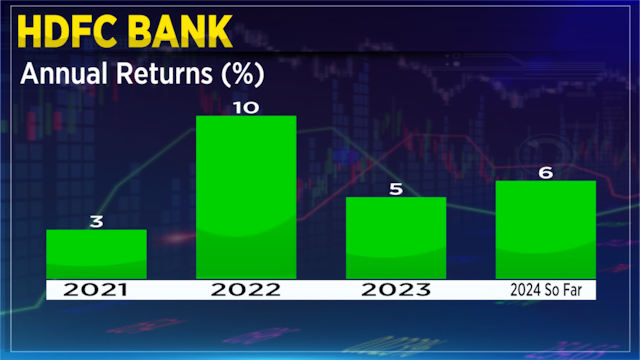

HDFC Bank has been delivering positive returns every year since 2013. But three of those last four years, the returns are in single digits. Yet, no analyst on the street has a sell rating on the stock with price targets ranging up to as high as ₹2,550.

FMCG is a sector that has disappointed this year and HUL is among those disappointment, with a 12% drop so far this year. This is the worst calendar year for the stock since 2004 and has delivered negative returns only four times since 2007. The street though remains optimistic on the stock with analysts giving price targets of up to ₹3,400.

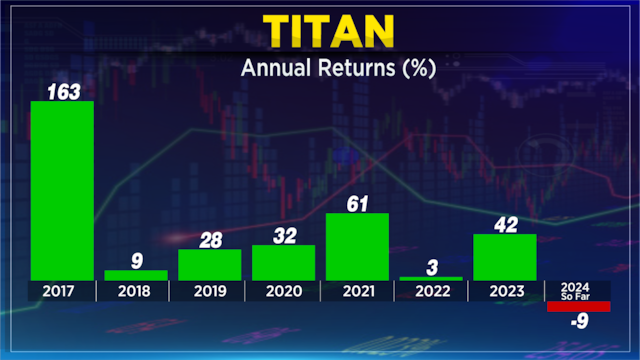

Staying with consumption, Titan is set for its first negative calendar year returns after 2016. Gains since 2016 have ranged between 10% to as high as 150%. The street though, expects the stock to touch as high as ₹5,000 but the bears keep it at ₹2,819.

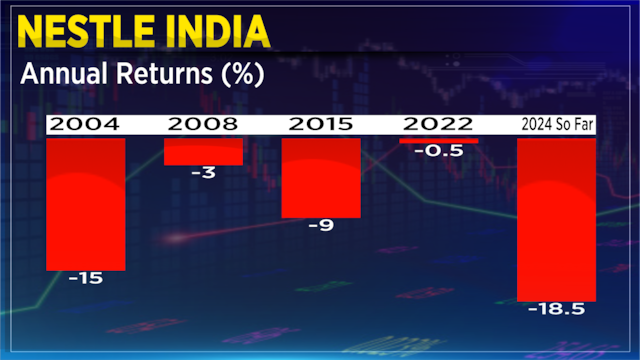

And rounding off the consumption theme is Nestle India. If HUL had its worst year since 2004, this is the worst for Nestle India since 2002. Only five time since 2002 has the MNC stock given negative calendar year returns. Most analysts have a hold rating on the stock with the highest price target of close to ₹2,900 rupees.

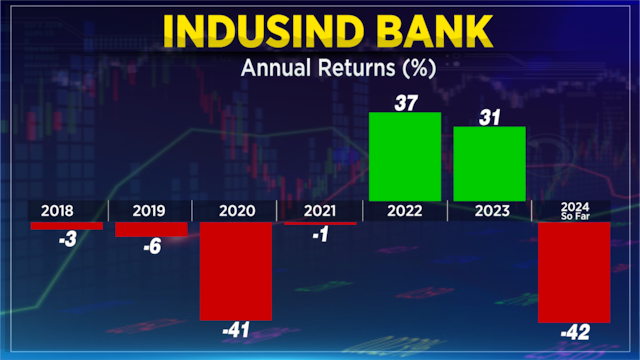

Banks make an appearance in this list with IndusInd bank. The stock is among the worst performer on the Nifty this year, down over 40%, and this is the fifth time in the last seven years that the stock has had negative returns. Yet, 37 analysts continue to maintain a buy rating on the stock with price targets ranging up to ₹1,950 rupees.

And lastly, despite all the newsflow this year and last, Adani Ports has managed a positive calendar year, the fifth time in a row it has done so. And analysts too have a near-consensus buy rating on the stock with price targets ranging close to ₹2,000 rupees apiece.