Chief Financial Officer Shalibhadra Shah said, “In the last two to three years, our PAT (profit after tax) growth has been almost 40%, and even in this financial year’s first half, we have grown at 47%.”

He noted that the company is benefiting from a strong business pipeline and industry trends like the financialisation of savings and increased equity participation.

“The momentum is very strong, and the pipeline remains heavy,” Shah said.

Also Read | Will there be a global recession in 2025?

Brokerage firm Investec estimates a 31% PAT CAGR (compound annual growth rate) for Motilal Oswal between 2023-24 (FY24) and 2026-27 (FY27), along with a 25% return on equity (RoE).

Investec recently initiated coverage on Motilal Oswal with a buy rating and a target price of ₹1,200 per share. It observed that all of the company’s operating businesses are well-positioned and gaining market share.

Revenue Mix (April-September 2025)

|

% of Revenue |

|

|

Brokerage |

34% |

|

NII |

31% |

|

Mgmt. Fees & Advisory |

20% |

|

Distribution |

11% |

|

Others |

4% |

Shah added that the company’s diversified model balances market cycles effectively.

Segments like wealth and asset management continue to perform strongly, offsetting any cyclicality in the broking business.

“Flows have been very sharp, and we see good momentum across these segments,” he said.

Motilal Oswal Financial Services plans to build on synergies across its businesses without any immediate plans for demergers or structural changes.

Read Here | Motilal Oswal’s top 10 stock picks for 2025

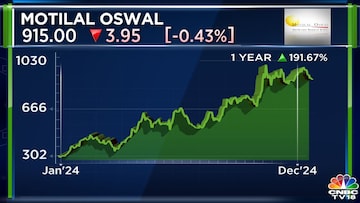

The company, which has a market capitalisation of ₹54,744 crore, has seen its shares rise 191% over the last year.

Also Read | Motilal Oswal expects shares of this jewellery company to double from their IPO price