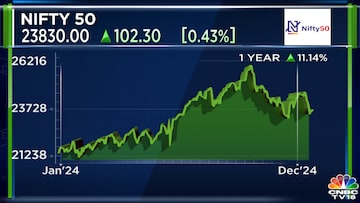

“A 10% correction from here in the Nifty would give us a slightly larger correction in mid-caps, and that could get interesting,” he said. Alternatively, Sanger added, if the market stays around current levels for a quarter, it could serve as a time correction and make valuations more reasonable.

The benchmark indices, Nifty50 and Sensex, have each gained approximately 9% year-to-date.

Sanger highlighted the abundant liquidity in India, which has driven substantial inflows into the market. “But for us to look at it globally, if the growth is not there, the valuations need to correct,” he said.

Also Read | Will there be a global recession in 2025?

Also Read |

Will there be a global recession in 2025?

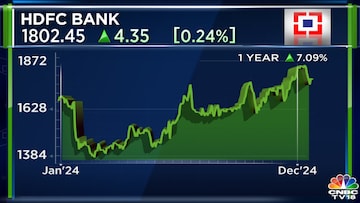

Sanger highlighted several sectors of interest, particularly the financial sector. He pointed to non-banking financial companies (NBFCs) and leading banks like HDFC Bank as having potential for the next phase of growth.

Also Read | Helios Capital’s Samir Arora bets on these sectors in 2025

Cement and basic materials sectors, he believes, stand to benefit from the ongoing capital expenditure cycle.

There are also opportunities in the underperforming consumption-related stocks, including niche areas such as travel and leisure, rural-focused fast-moving consumer goods (FMCG), and electronics retailers.

These segments, he noted, could leverage evolving consumer trends and targeted growth drivers in the Indian market

For more details, watch the accompanying video