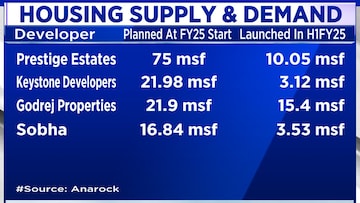

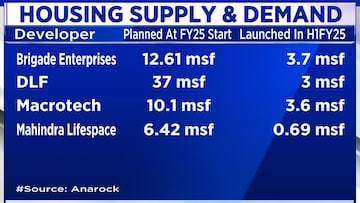

However, by the middle of the year, only 57.15 msf of this planned supply had been launched, falling short of the expected targets due to election-related delays in approvals, according to Anuj Puri, Chairman of Anarock Property Consultants.

“Demand continues to remain strong, and the developers are financially sound,” Puri added in a conversation with CNBC-TV18.

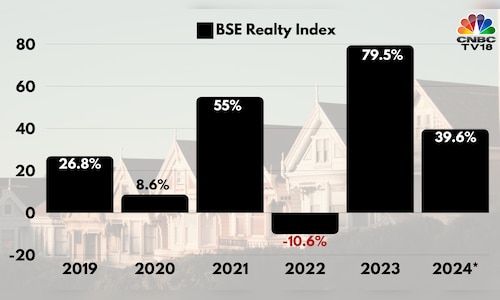

The BSE Realty Index, which measures the performance of stocks in the property sector, has had a good year but not as good as the last one. The index is up 39% in 2024, as of Dec 19, compared to over 79% gains in 2023.

Despite the delays in new launches, the developers’ financial health has improved significantly. The combined debt-to-equity ratio of the listed realty stocks is down to 0.5, almost half of the 0.9 in 2019. “I do feel that the second half will be very strong, with more launches and demand picking up,” he said.

Read Here | Gurugram overtakes Mumbai as India’s new ultra-luxury real estate hub

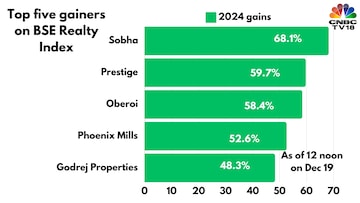

These are the best performing real estate stocks in 2024:

According to Anarock data, the inventory of unsold homes is down to 14 months, the lowest level ever. Typically, this number hovers between 20 to 22 months, Puri said.

If the demand is strong, as Anarock’s Puri suggests, particularly in the higher-income segment, the lack of new supply could lead to a spike in home prices, especially in the big cities.

Read Here | Pune property registrations drop 11% in November 2024: Report

(Edited by : Sriram Iyer)