SUMMARY

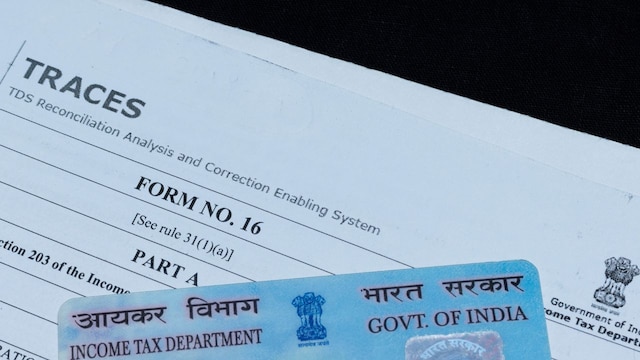

A PAN card, a ten-digit alphanumeric identifier issued by India’s tax department, is required for filing taxes, claiming credits, and financial transactions. It can be applied for through online portals like NSDL eGov, UTITSL, or the Income Tax E-filing Portal.

Applicants can submit their PAN applications through Protean (NSDL eGov), UTITSL, or the Income-tax E-filing Portal for instant e-PAN. After selecting a portal, applicants must fill out an online form with their contact information and details. (Image: Shutterstock)

Applicants must submit the necessary documents based on their status (Individual, HUF, etc.) to Protean or UTITSL via post or courier. In some cases, e-verification using Aadhaar-based OTP can be used instead of sending physical documents. (Image: Shutterstock)

The application fee is ₹91 (excluding GST) for Indian addresses and ₹862 (excluding GST) for foreign addresses. Payments can be made via credit/debit cards, demand drafts, or net banking. (Image: Shutterstock)

Applicants must submit proof of identity, address, and a recent photograph. For applications after November 1, 2009, individuals and HUFs using an office address must provide both office and residential address proofs. (Image: Shutterstock)

Aadhaar-linked individuals can avail the Instant E-PAN service, which is paperless and free of charge. The valid e-PAN can be accessed through the Income-tax E-filing Portal, requiring a registered mobile number with Aadhaar. (Image: Shutterstock)

PAN cardholders can request a reprint for ₹50, which includes a QR code, after updating their details in the Income Tax records. Corrections to PAN details can be made free of charge before applying for a reprint. (Image: Shutterstock)