As any central bank, the US Federal Reserve is supposed to use monetary policy to keep prices from moving too much, too fast. Donald Trump’s declared position on many policy issues are likely to stoke inflation and that’s a big reason why Fed chair Jerome Powell has had to scale back the projections for rate cuts in 2025. Photo source: Bloomberg.

“So, we have people making a bunch of different approaches to that. But some did identify policy uncertainty as one of the reasons for their writing down more uncertainty around inflation,” Powell said in the post-policy press conference. He didn’t commit to a ‘definitive answer’ on how much inflation President-elect Trump’s proposed tariffs may cause. File photo.

Trump has threatened many exporting countries, not just China, with tariffs as a strategy to increase manufacturing in the US. New factories won’t come up overnight, and in the meantime, the cost of imports will rise for American consumers. “People are still feeling high prices… The best we can do for them, and that’s who we work for, is to get inflation back down to its target,” Powell said. So, prices are still high and rising tariffs could make them worse. Photo source: An employee works at an auto parts manufacturing company in Qingzhou, in China’s eastern Shandong Province on December 9. Source: AFP/Getty Images via Bloomberg.

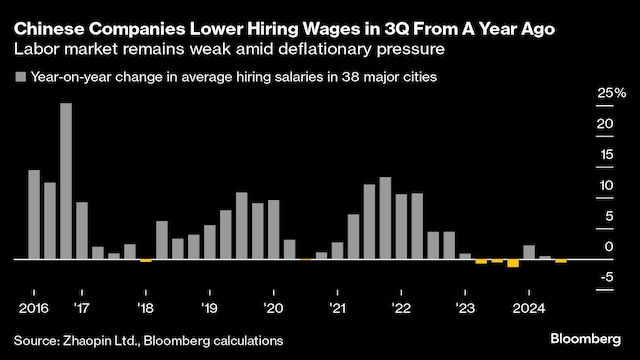

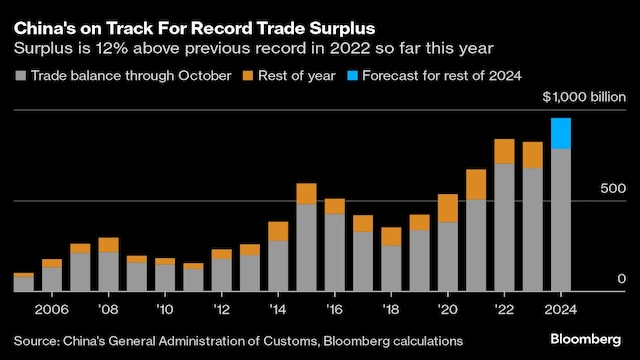

On the other hand, China is trying to break out of a deflationary cycle and boost both economic growth and prices. For much of 2024, the slump in the Chinese economy had forced the prices of the country’s produce, with the excess being shipped overseas at cheaper rates.

Steel makers in India have already complained about the dumping from China and sought government protection against the Chinese steel flooding the market. This is just one example of how China’s deflation helped keep prices under check around the world, including the US.

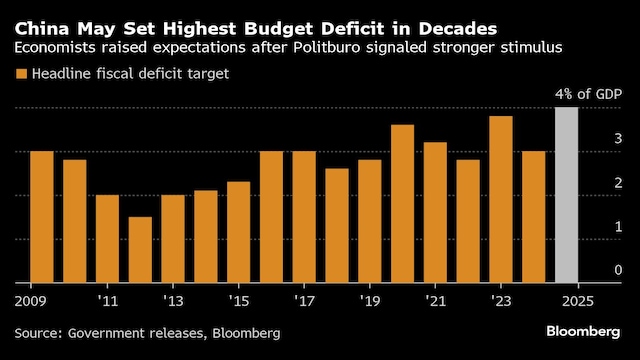

However, China aiming to boost government spending and allow the fiscal deficit to climb to 4%, the highest in three decades, will likely cause inflation in the economy, which China can afford because the prices have been falling for so long but for the US, additional tariffs on imports that are already at higher prices would be a double whammy.

Not so rosy for the US, which imported over $500 billion worth of goods and services from China in 2023, accounting for 14% of its total imports. While China ranks third among countries that export the most to the US, a significant portion of the exports from Mexico to the US are also Chinese goods, just re-routed to beat the barriers.

Put together, China’s efforts to reflate its own economy and Trump’s idea to use tariffs as a negotiating tool in international trade are likely to mean higher prices for US consumers. Powell seems to imply that the Fed can’t ignore it. The Fed dot plot may be a reflection of exactly those fears.

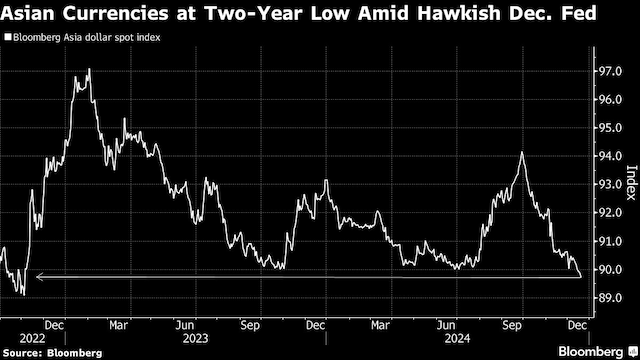

Rising inflation and slower rate cuts in the US may weaken emerging market currencies like the rupee, making imports like crude oil and gold more expensive for countries like India.